The Volatility Index (VIX) just generated its third broad stock market “buy signal” of 2025. All three occurred within the last 10 days.

The first two signals reversed immediately. So, bullish traders are hoping this third time will be the charm.

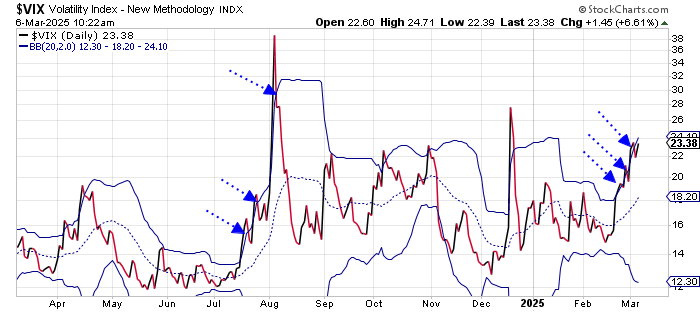

You may recall from my recent essay that VIX buy signals occur when the index closes above its upper Bollinger Band, and then closes back inside the bands.

We’ve noted these signals many times over the years… and the track record is outstanding.

Everyone once in a while, though, the signal misfires. Rather than rallying right away, the stock market falls – sending the VIX higher and above its upper Bollinger Band again. This action negates the buy signal.

But, with the VIX above its upper Bollinger Band once again, the action sets the stage for a rare “double” VIX buy signal when the index closes back inside the bands.

It is rarer still to get two failed VIX buy signals back-to-back – thereby setting the stage for a “triple” VIX buy signal. That is, however, what the market is set up for right now.

Take a look at this chart of the VIX…

You can see the three VIX buy signals that have happened over the past two weeks.

We don’t often see clusters of VIX buy signals. But, when it happens, it leads to “V” shaped rallies.

For example, last July/August we got a cluster of three VIX buy signals in about a two-week period.

The first two signals failed.

Following the third signal, though, the S&P 500 rallied 400 points (8%) in about 10 days.

A similar move this time around would have the S&P 500 challenging the top of its recent trading range – near 6100 – by St. Patrick’s Day.

I don’t recall ever seeing three failed VIX buy signals in a row.

So, given the outstanding track record of this indicator, and given the large move that occurs following a cluster of buy signals, traders should take advantage of any weakness to add long exposure to the stock market.

We’re due for at least a short-term rally.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.