Managing Editor’s Note: TradeSmith – premier provider of fintech software and financial newsletter behemoth – is celebrating its 20th anniversary this week.

Since Jeff is TradeSmith’s newest editor, TradeSmith CEO Keith Kaplan has some special offers up his sleeve that are perfect for Jeff’s subscribers to take advantage of (check that out right here.)

Jeff and TradeSmith are a perfect match, because at the core of both Jeff’s and TradeSmith’s mission is a very simple philosophy: dedication to helping everyday investors navigate volatile periods like we’re in now, so you can profit on both the ups and downs in markets with the least amount of risk.

Today, we’re hearing from our contributing editor Mike Burnick during his weekly Thursday feature slot.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Watch This Crossroads Indicator…

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

The stock market appears to be back on track to the upside, at least for now. The bounce off the recent lows is not surprising, considering how stocks were extremely oversold.

Plus, the rally has been accompanied by improving market breadth (more advancing than declining stocks, more upside vs. downside volume). That’s the good news.

The potential bad news is that we should all circle our calendars for Wednesday, April 2. That’s when the Trump administration is set to levy reciprocal tariffs against our trading partners.

Meanwhile, stock volatility as measure by VIX has dropped sharply back under 20 today, down from a peak near 30.

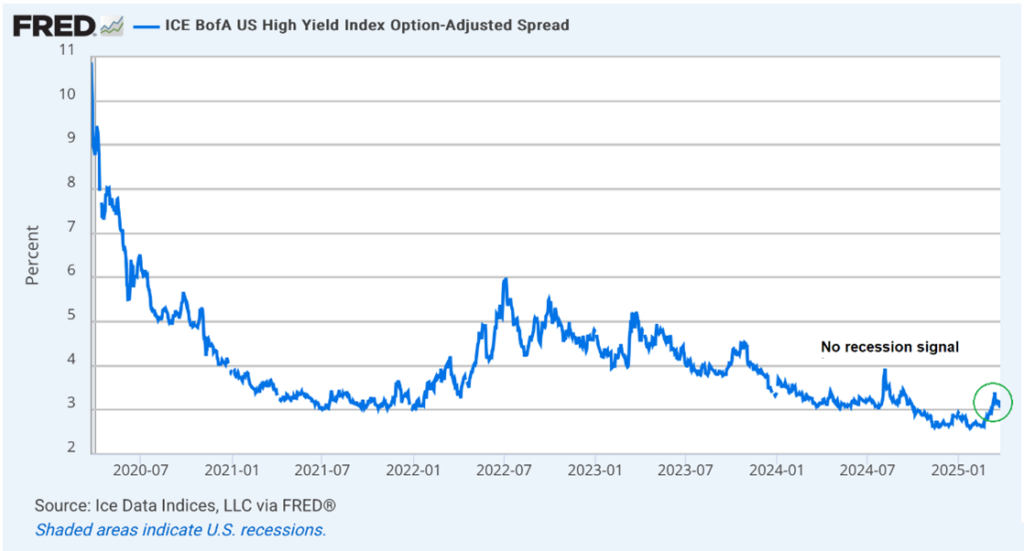

And it’s not just stocks getting less turbulent. Bond market volatility has calmed too, especially high-yield bonds.

As you can see above, the spreads between junk bond yields and yields on Treasury bonds did spike a bit higher recently, but not significantly.

Now high-yield bond spreads have retreated lower… and that’s more good news.

Look, everyone and their mother is worried about a tariff war driving the economy into recession. But if that were the likely scenario, the junk bonds would be selling off massively.

That’s because companies that issue junk bonds typically have highly leveraged balance sheets. In a true recession scenario, junk bonds would most likely plunge in value farther and faster than stocks.

But that’s not what’s happening, and that’s key to the outlook for stocks from here.

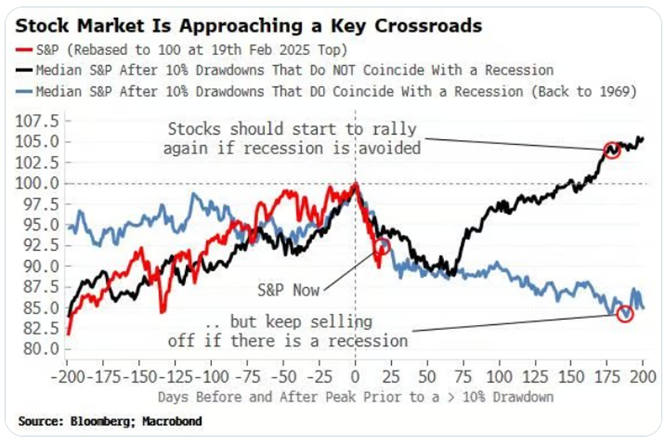

Looking at the chart above, I’m reminded of my favorite Robert Frost poem, The Road Not Taken. “Two roads diverged in a yellow wood, and I – I took the one less traveled by, And that has made all the difference.”

The stock market is approaching a historic crossroads, too.

The black line above charts the path stocks have taken after a 10% market correction that is NOT accompanied by recession. That’s the high road where stocks continue to rally.

The low road on the other hand is the path stocks have taken when there IS a recession in the aftermath of a market correction.

For now, my money is still on the high road scenario.

Mike Burnick’s Bottom Line: Recent data shows the economy has slowed somewhat but reports of a recession are being greatly exaggerated. Keep a watchful eye on stock and bond market volatility, plus high-yield credit spreads, and you’ll have an early warning of trouble ahead.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.