Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Sell Stocks in May and… Buy Bonds Before You Go Away

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

I can’t tell you how many times I’ve heard the old Wall Street adage to, “sell in May and go away” over the past week.

And while I find it a bit annoying, (like the Santa Claus rally in December), there is a bit of truth to this timeless maxim.

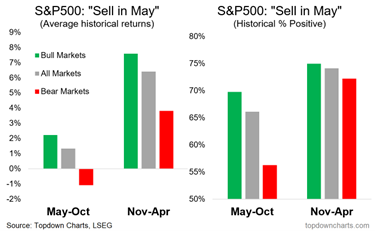

As you can see above, stocks do tend to perform worse both in terms of historical returns and success rate (% positive) from May through October. This compares to much higher average returns and success rates from November through April.

And the difference in results holds true whether stocks are in a bull market (green bars) or a bear market (red).

On the other hand, Treasury bonds tend to experience just the opposite trend, with gains typical during the period from May to September, as you can see here.

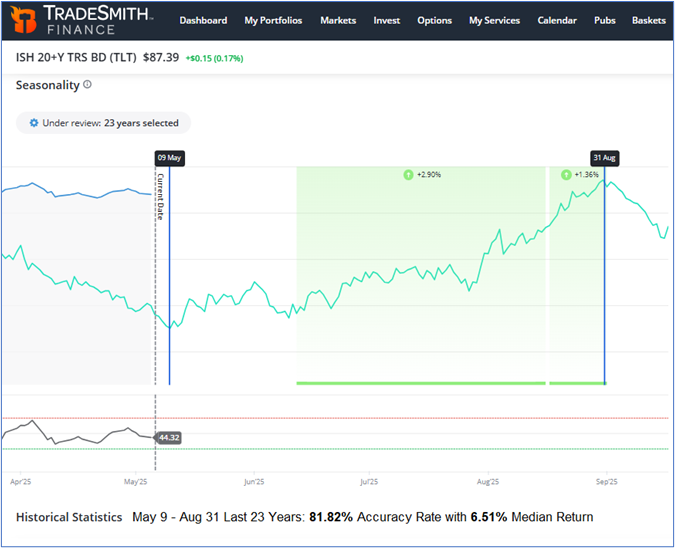

In fact, our own TradeSmith cycles and seasonality indicators back up this claim. I analyzed returns of the iShares 20+ Year Treasury Bond ETF (TLT) over the past 23 years of its existence.

And sure enough, as you can see below, there has been a consistently bullish period for TLT from May 9 through August 31 over the years.

Here are the detailed stats on this possible seasonal trade:

- 82% Accuracy Rate over 23 years

- +6.51% Median Return (+4.95% average return)

- +16.71% Annualized Return

Mike Burnick’s Bottom Line: Those stats aren’t too shabby from boring old bonds. And that’s especially true during a multimonth period over the summer when stocks tend to struggle. Perhaps the adage should be modified to “sell stocks in May and buy bonds before you go away!”

Good investing,

Mike Burnick

Contributing Editor, Market Minute