Managing Editor’s Note: Today, we’re handing the reins over to our colleague Jason Bodner.

Jason is an expert at finding “Big Money” companies that avoid hype and outperform the market based on fundamentals.

And with that, he has developed the incredible “Quantum Edge System” that helps him find these winners.

And it works – Jason’s Quantum Edge Pro portfolio is up 7.5% so far in 2025, while the S&P 500 has only gained 1.5%.

This Memorial Day Forecast Could Put Money in Your Pocket

BY JASON BODNER, EDITOR, QUANTUM EDGE PRO

I’m always looking for trends to identify great stocks. And one just smacked me right in the face: that sticky and sweaty Florida humidity.

This weekend marks the unofficial start to summer. At least for much of the United States… It’s been hot and humid here in Florida for a while now.

The end of the school year is right around the corner, community pools are reopening, and people are itching to use their vacation days for some warm-weather travel.

According to AAA, more people than ever will hit the road this Memorial Day weekend. Domestic travel is forecast to increase by 1.4 million travelers over last year to 45.1 million, which would surpass the previous high from 20 years ago.

Most people will hit the open road, with 39.4 million expected to travel by car. And despite some unsettling headlines lately, air travel is expected to increase 2% to 3.61 million people. American Airlines expects the highest number of passengers today and tomorrow.

Clearly the data backs up what I’m feeling. Summer is here, and that means summer travel is ramping up.

That has to drive some stocks higher, right? I fired up my Quantum Edge system to see which travel-related stocks have the highest odds of making money.

Wynn Resorts (WYNN)

Wynn Resorts most famously owns and operates the Wynn and Encore hotels and casinos in Las Vegas. It also has resorts in Boston and Macau – an autonomous region on the south coast of China – and will debut its latest location on Al Marjan Island in the United Arab Emirates in 2027.

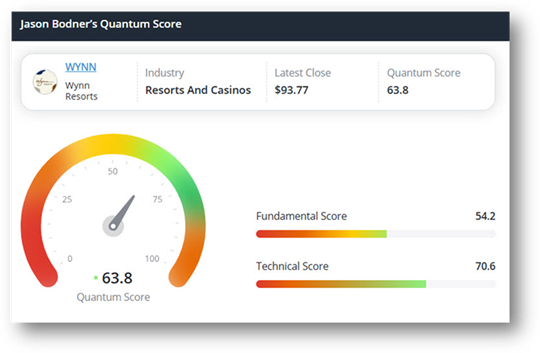

From a quick glance at its Quantum Score and mediocre fundamentals, WYNN doesn’t seem to fit. I like a score between 70 and 85, and I prefer to see the fundamentals also above 70. So, overall, WYNN doesn’t quite measure up:

Source: TradeSmith Finance

But something caught my eye that most Discretionary stocks aren’t seeing at the moment… at least not yet.

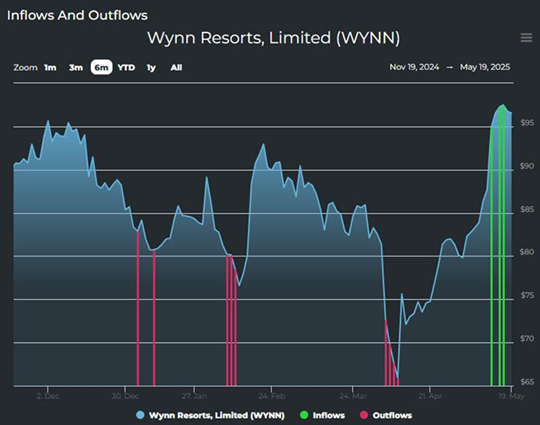

Check out those green bars below. Those signal unusually heavy inflows:

Source: MoneyFlows.com

After some selling (the red bars) in the beginning of the year and during early April’s historic sell-off, Big Money just started flowing into this stock. My system picked up those three buy signals just last week. That contributes to WYNN’s healthy Technical Score of 70.6.

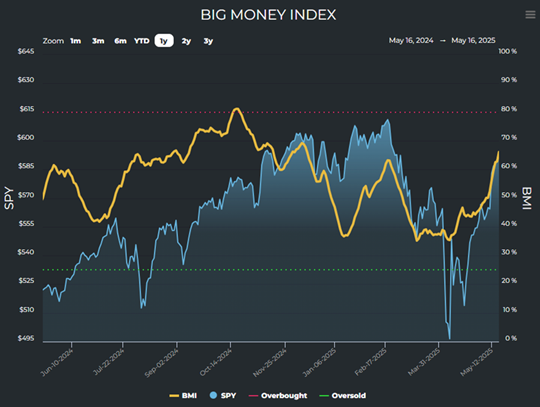

My Big Money Index, which tracks unusually large money flows, has surged since its April 8 bottom after all the post-Liberation Day panic selling. Back then, that index was at just 37.1, meaning two out of every three Big Money signals were sells. Now, as I wrote in Quantum Edge Pro this week, the situation has essentially reversed, with the Big Money Index shooting all the way up to 66.1 in just six weeks:

Source: MoneyFlows.com

Inflows sharply increased last week after the United States and China reached a temporary tariff agreement, which is exactly what you’re seeing above with both the broad market and WYNN, specifically.

That’s not enough to call this a buy, though I definitely think it’s worth watching. I look for companies with strong fundamentals, which give us a higher probability of success, and WYNN’s aren’t where I like to see them.

I’m keeping WYNN on my watch list. Big Money often knows something before the rest of us do, which is why tracking money flows is so important. I would like confirmation that those recent inflows aren’t just a stronger market but also indicative of institutional interest in WYNN itself.

Royal Caribbean Group (RCL)

AAA says a record 19 million Americans plan to take cruises this year, and I’m sure you’ve heard of Royal Caribbean. It’s one of the most popular cruise lines, and you may have even taken one of their cruises before.

RCL’s newest ship, the Icon of the Seas, set sail in January 2024 and is the largest cruise ship in the world at nearly 1,200 feet. It has more than 40 restaurants and bars, a water park with six different water slides, an ice-skating rink, an open-air space called Central Park, and can accommodate up to 7,600 passengers.

This cruise line is about more than one ship, though.

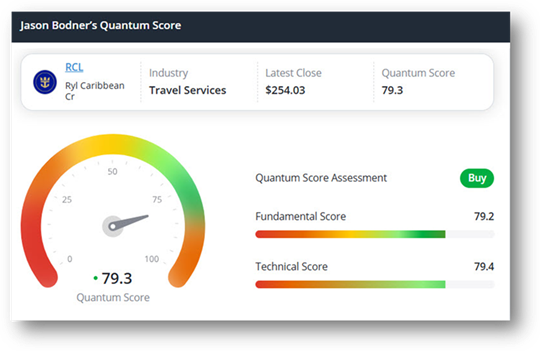

RCL stock has excellent scores, so it definitely rates as a buy:

Source: TradeSmith Finance

RCL’s one-year sales growth of 18.6% and muscular three-year growth of 184.3% lead to its strong Fundamental Score of 79.2. I also like RCL’s solid 17.5% profit margin and high institutional ownership of 81.6%. That’s the Big Money.

All of this leads to Royal Caribbean’s impressive Quantum Score of 79.3. That’s right in my optimal buy zone. And while my system hasn’t picked up any buy signals since the end of January, the data still shows opportunity. And I anticipate more buy signals as institutional money increasingly flows back into stocks.

Ryanair Holdings (RYAAY)

This one may be the sleeper of the bunch. Ryanair isn’t all that well known in the United States, but it’s Europe’s largest airline group (by passenger numbers). Ryanair is an Irish company consisting of several low-cost airlines that primarily offer short-haul flights in Europe, North Africa, and the Middle East.

That might not be where people are heading this holiday weekend, but Europeans love to travel, too, and people from all around are traveling to that part of the world. The European Travel Commission found that despite rising global uncertainty, international tourist arrivals to Europe rose 4.9% in the first quarter this year.

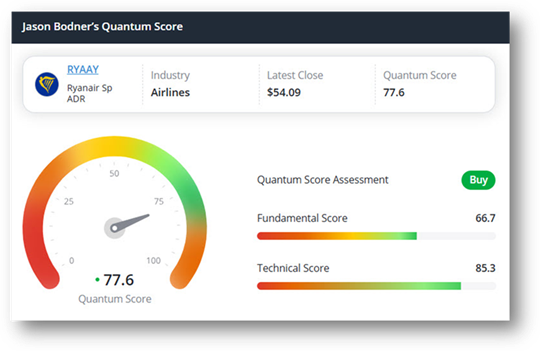

Plus, RYAAY too scores right in the sweet spot for Quantum Edge:

Source: TradeSmith Finance

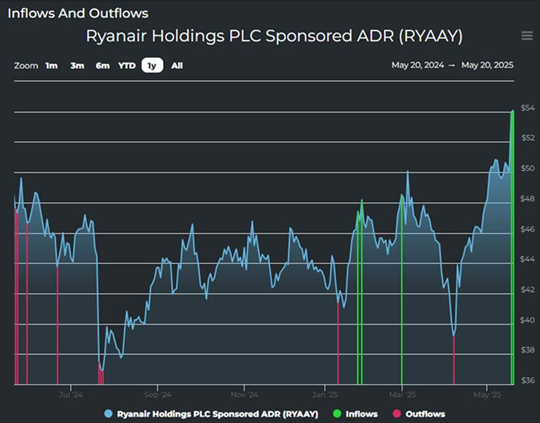

Big Money is flowing into Ryanair, with five buy signals so far this year, including two earlier this week:

Source: MoneyFlows.com

RYAAY has the fundamentals to back it up. It boasts a profit margin of 14.3%, with one- and three-year sales growth of 30.1% and 107.9%, respectively.

The company reported this week that passenger traffic grew 9% to 200 million during the most recent quarter, though profits fell slightly due to a 7% decline in airfare.

With a Quantum Score of 77.6, Ryanair is right in my optimal buy zone.

We can all spot trends around us (like travel and tourism) and use those as starting points for investing research. It’s ultimately the data and analysis behind my system that pinpoints exactly where the best opportunities are.

Add the ability to track those all-important money flows, and you’re likely to arrive at your destination of greater wealth.

Happy travels! I hope your investments help fund your summer travel plans.

Talk soon,

Jason Bodner

Editor, Quantum Edge Pro

P.S. Our Quantum Edge Pro portfolio outperformed last week, surging 7.2% on average versus the S&P 500’s 5.3% gain. Our stocks were led by multiple winners with 15%-plus gains in just one week.

And from a broader perspective, we’re up nearly 7.5% so far in 2025, while the S&P 500 has only gained 1.5%.

The headlines will change, but money flows – the big waves of institutional money – really move stocks. We see that in how strongly our Quantum Edge Pro stocks have bounced since the April lows.

I’m also continuing to screen for fresh opportunities with the key quant ratings that put the odds in our favor.

To learn more about my Quantum Edge system, go right here.