Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

What America’s Profit Slump Means

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Don’t look now, but just as S&P 500 valuations are reaching nose-bleed levels again, the stock market profit engine may be running out of gas.

Stocks remain in rally mode as the S&P 500 and Nasdaq hit record highs to end the first half of the year on a high note.

The rally kicked off thanks to delayed tariffs but was supported in large part by strong first quarter S&P profits that beat expectations.

But profits for big-cap stocks in the index aren’t the whole story.

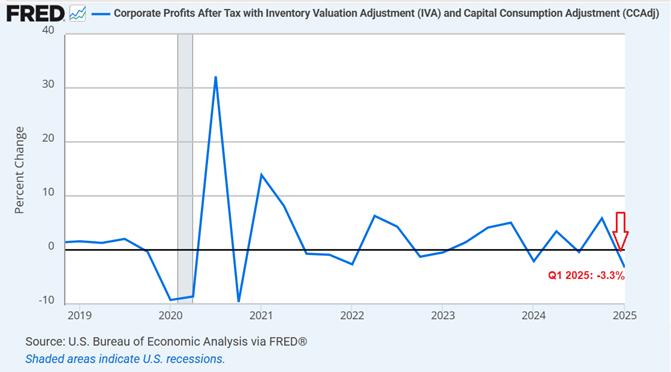

Last week, revised Gross Domestic Product (GDP) data showed that overall, after-tax profits fell -3.3% in the first quarter, after years of mostly steady profit growth.

And three percent may not sound like much, but it adds up to a -$90.6 billion hit to America’s profitability in the first three months of 2025.

Profits earned internationally by American businesses were the biggest casualty, down by $72.5 billion. The domestic manufacturing sector was hit especially hard, with profits dropping $47 billion in the quarter.

The profit decline was led by motor vehicles and fabricated metal products, among other U.S. durable goods producers. And it’s no coincidence that some of the highest tariff rates are applied to these industries.

This is likely just the early evidence of tariff-related costs hitting American companies. And it tells me that our biggest businesses have a lot to lose from the trade war.

S&P 500 companies earn 40% of total sales from international customers. And this profit decline isn’t a good omen for second-quarter S&P 500 earnings, with results about to be reported over the next several weeks.

According to Wall Street estimates, profits for the index are expected to rise only 2.3% year over year, the smallest growth in two years.

In fact, just six out of 11 S&P 500 sectors are forecast to grow their earnings at all in the second quarter, the least since early 2023.

Mike Burnick’s Bottom Line: This may be the first hard evidence that American corporate profits are under pressure from tariff costs. So, there is a lot riding on upcoming earnings reports… the continuation of the stock market rally may be at stake.

Good investing,

Mike Burnick

Contributing Editor, Market Minute