Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Here’s Why Index Funds Can Be Risky Business Today

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

If you have money invested in an S&P 500 Index fund – as untold millions of investors do – you have two problems.

The first is a severe lack of diversification, because what you’re getting for your investment buck in these funds isn’t really a diverse list of 500+ blue chip companies.

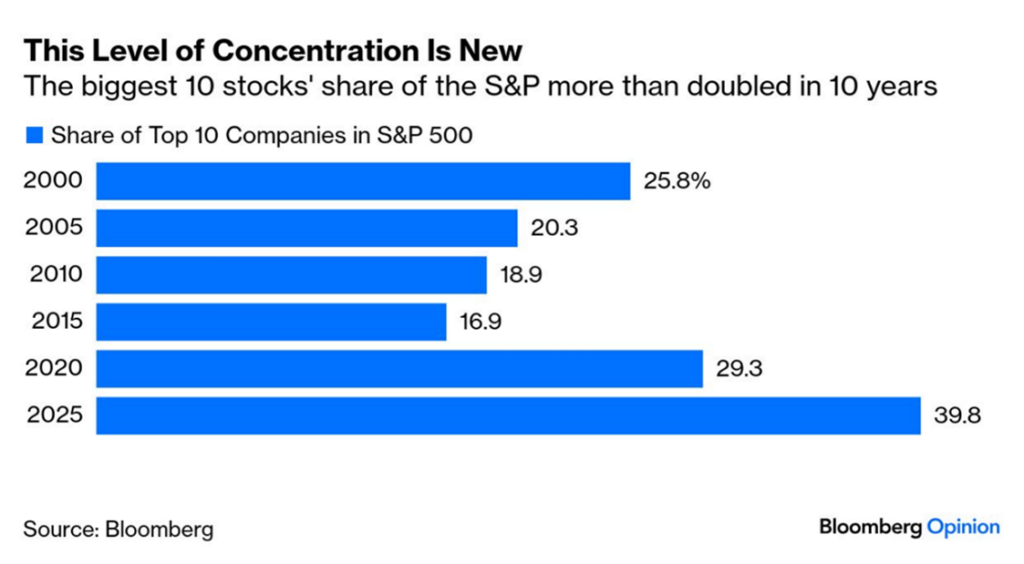

In reality, 40% of your money is actually going into just 10 stocks, which is an all-time-high level of top-heavy concentration for the S&P 500.

In fact, it’s more concentrated now than before the dot-com bust in 2000, when the top 10 stocks accounted for over 25% of the index weight.

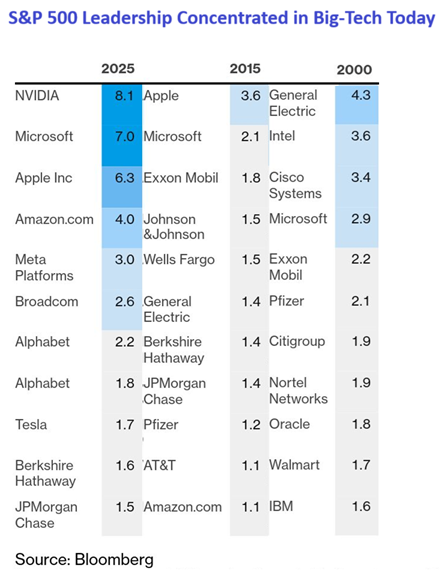

At least back in 2000 there were a few banks, healthcare, energy, and industrial stocks thrown in for good measure.

Today, it’s all tech, except for JPMorgan Chase and Berkshire Hathaway…

And aside from the lack of diversification, the other big problem for this top-heavy investment is… higher risk.

The dominance of these mega-cap stocks in the S&P 500 makes the index itself a lot riskier. That’s because these stocks are extremely sensitive to the twists and turns in financial markets.

There’s a fancy Wall Street term for this known as “beta.”

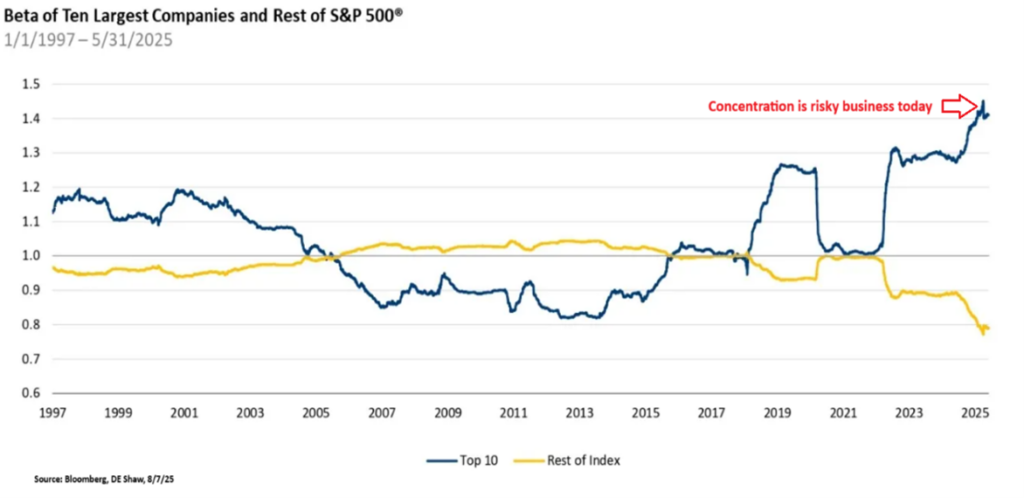

A stock with a beta of 1 generally moves with the market. While a stock with a beta of 1.25 would move 25% more, both up and down, than the market. Finally, a beta below 1 means the stock is more defensive and moves less than the market.

Just 10 years ago, the beta of the top 10 stocks in the S&P 500 was about 1, the same as the market’s beta.

Today, the beta of the top 10 stocks is nearly 1.5, or 50% more volatile than the market.

The rest of the S&P 500 index, excluding the top 10 stocks, has a beta of just 0.80 today, or about 20% less volatile than the market.

We saw this play out live during the tariff turmoil early this year. The Magnificent 7 stocks as a group plunged 30% while the equal-weighted S&P 500 fell just 17%.

Bottom line: Although we haven’t experienced a similar selloff since the April low, experience says another is coming sooner or later. And when it does, owning the top 10 stocks, or an S&P 500 Index fund for that matter, could be very risky business.

Good investing,

Mike Burnick

Contributing Editor, Market Minute