The technology sector just performed a stick save.

Hockey fans know a stick save is when the goalie uses his stick to deflect a shot, preventing it from entering the net. Technical traders use the term to describe market action that prevents an obvious pattern from playing out.

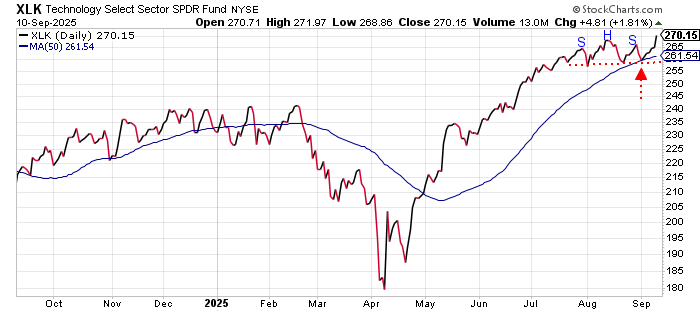

Two weeks ago, the technology sector ETF (XLK) was setting up a potentially bearish “Head & Shoulders” reversal pattern. It was signaling the possibility of significant downside action ahead for technology stocks.

It wasn’t a guaranteed breakdown. In fact, I pointed out the action that could negate the bearish pattern…

“If XLK can rally above $270 and make a new high – before it makes a lower low – then this pattern is negated, and the uptrend remains intact.”

That’s what happened this week. We got a stick save.

Here’s the updated chart…

XLK did indeed head lower in the days after we noted the possibility of the bearish H&S pattern. The stock tested the double support of its 50-day moving average, and the “neckline” of the Head & Shoulders pattern. All the bears had to do was apply enough selling pressure to break those support levels, and the pattern would have likely played out with a swift move lower.

Instead, we got a stick save.

The bulls stepped up. XLK bounced off of support. And, that bounce has been strong enough to push XLK up to a higher high.

The H&S pattern has been negated. The bulls are back in charge. And, as long as XLK can hold above $259, the momentum remains bullish.

From here traders should pay close attention to how the next pullback plays out. If XLK forms a higher low and starts to rally again, then the uptrend is firmly intact. On the other hand, if XLK fails to make a higher low, and instead retests the $259 support level, XLK could be setting up a more complex H&S pattern – which could lead to a more significant decline.

For the moment, though, this week’s stick save keeps the bullish trend intact.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.