Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Stocks are Overpriced, But Folks Are All-In Anyway

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

It’s official, investors are all-in on stocks… just in time for negative seasonality to kick in.

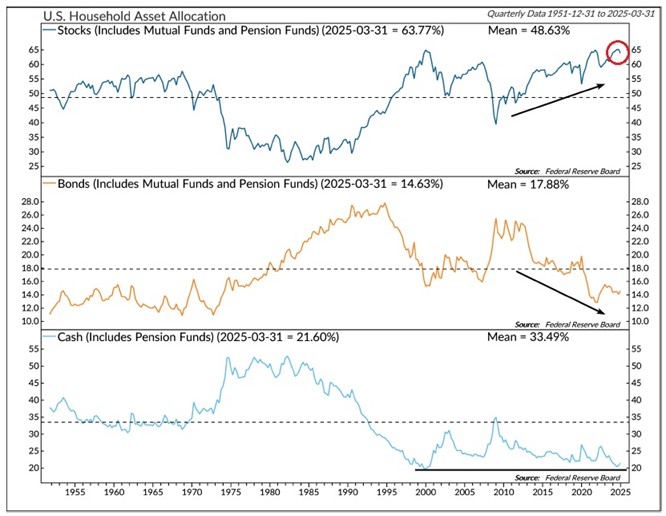

According to Federal Reserve data, American households’ allocation to stocks hit a record high in 2024, at 49.3% of total financial assets.

And the chart below shows you the share of individual stocks, plus mutual fund shares and pension funds that hold stocks is likewise at a high near 64%.

That’s well above (by about 15 percentage points) the average level of stock holdings (48.6%) over the last 75 years!

Meanwhile, Americans’ appetite for bonds and cash are hovering near multi-decade lows. That’s what I would call an all-in signal for stocks of the dangerous kind. And it could spell trouble ahead for the stock market.

For context, the recent high in household allocation to stocks eclipsed the previous two peaks in 2006 (38.3%) just before the global financial crisis. And it also exceeds the previous record (45.2%) just before the dotcom bust in 2000.

That’s pretty good company… if the company you keep is peak investor sentiment just prior to major bear markets.

Perhaps ironically, the vast majority of investors also believes that the stock market is overvalued today. But apparently they’re happy to keep buying anyway.

At least that’s the view from the latest Bank of America Fund Manager Survey, where nearly 60% of professional investors polled recently say the stock market is overpriced.

It’s the greater fool theory at work, at least until the music stops.

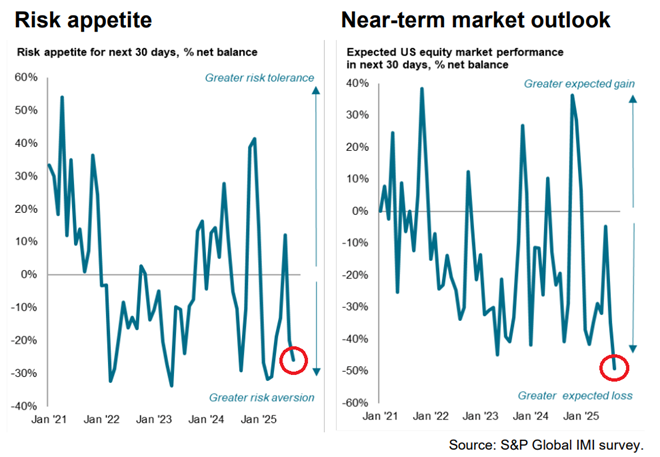

But the headlong rush into stocks may be about to change, at least according to the latest data from S&P Global, where investment managers suddenly turned risk-off in a big way.

The “risk appetite” index for investors fell to -26% (above left), the lowest since April during the tariff trauma stock market selloff.

Short-term expectations for stock market returns also fell to the lowest level on record since this data began in 2020. The expected stock market outlook fell to -50%, with the majority of investors seeing greater chances for stock market losses than gains over the next 30 days!

The biggest concern cited by investment managers for their pessimistic outlook was, you guessed it, current valuations compared to history.

Investors are also turning quite defensive in their asset allocations with a majority of managers investing in defensive sectors including healthcare and utility stocks.

If the big money is preparing for trouble ahead… then maybe you should, too.

Bottom line: So far September hasn’t lived up to its billing as the worst month for stocks, but the next few weeks have historically experienced negative returns. And the fact that investors are all-in on stocks, despite also believing they are overvalued, tells me euphoria could quickly unwind. That’s not to say you should turn outright bearish, but caution is well advised, similar to the newfound risk-off cautious stance by investment managers.

Good investing,

Mike Burnick

Contributing Editor, Market Minute