There are two canaries coughing now.

Last week, we looked at the lagging action in the banking sector and noted its weak performance is often a warning sign for the broad stock market. Since then, bank stocks have continued to fall. In fact, as the S&P 500 rallied to another new high on Wednesday, the KBW Banking Index (BKX) fell more than 1%.

The index is now sitting precariously on the support of its 50-day moving average line. If the banks break down from here, it’s hard to see the broad stock market holding up.

And, the banks aren’t the only canary in the coal mine.

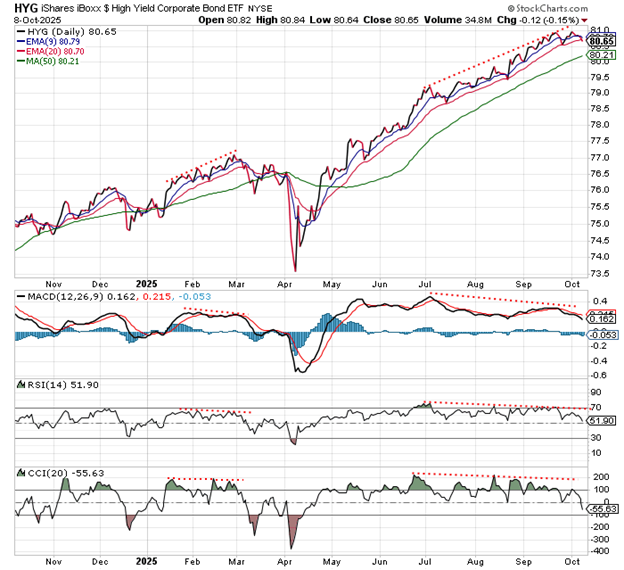

We’ve often written about how the action in high-yield bonds tends to lead the action in the stock market by anywhere from two days to two weeks. So, it’s worth noting the iShares iBoxx High Yield Corporate Bond Fund (HYG) appears to be rolling over.

Here’s the chart…

HYG has been pressing steadily higher since July – making new highs along with the stock market.

Notice though, all of the momentum indicators at the bottom of the chart peaked in July and have been moving lower ever since. This sort of “negative divergence” is often an early warning sign of an impending decline. Though, it usually does not take so long to play out.

And now, while the S&P 500 has rallied in October, HYG is trading lower. The chart now resembles a “rounding top” pattern. HYG is sitting on the support of its 20-day EMA. A decisive break below this level will confirm that high-yield bonds have entered at least a short-term decline phase.

That’s another canary that has fallen ill.

Meanwhile, the US dollar is rallying. That’s often a headwind for stocks. And, the Volatility Index (VIX) looks poised to explode higher.

Soon, we could have a whole flock of canaries lying stiff on the bottom of their cages.

Granted… the stock market’s momentum train has been unstoppable so far. But, as they say, trees don’t grow to the sky. What goes up must come down. And, when the canary passes out, it’s time to get out of the coal mine.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.