The S&P 500 Index is up 17.5% so far this year, which sounds good on the surface. After all, stocks on average gain just about 8% a year over the long run.

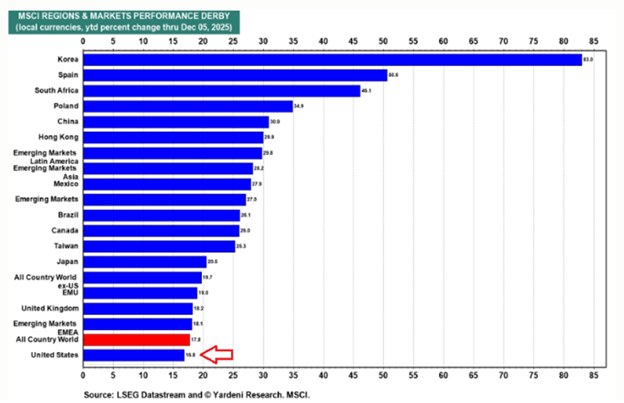

But in the derby of global stock market performance, we place a distant 20th on the list of top-performing markets or regions this year.

MSCI All-Country World Index Ex-USA Index (ACWX), a broad measure of global stocks outside the US, is up over 31% year-to-date, almost twice the gain of the S&P 500!

Chock this up at least in part to the weak US dollar, which fell 10% in value against other currencies in the first half of this year before rebounding a bit.

A cheaper buck makes international stock gains more lucrative in dollar terms. But a dropping dollar isn’t the whole story.

Breadth in international stock market gains is likewise outperforming the S&P 500.

In fact, over 90% of global stock markets are trading above their long-term trend, the 200-day moving average (MA). Meanwhile, just over 60% of S&P 500 stocks are above their 200-day MA.

The main reason for the outperformance of international stocks has to do with much more attractive valuations than US stocks.

The S&P 500 Index trades at 30x earnings today while the ACWX trades at just over 18x earnings. That’s a 40% valuation discount for stocks outside the US.

In fact, every stock market sector is cheaper to invest in globally than in the US, as you can see here.

Want to stay invested in information technology because of the AI boom? Then invest in tech internationally… where stocks are nearly 30% less expensive than tech stocks in the S&P 500 index.

The prize for cheapest international sector goes to consumer discretionary stocks, trading at a 43% discount compared to the S&P 500 consumer discretionary sector.

Think of stocks like Toyota Motors, Sony, and Hermes International, among other cheap discretionary names found in the ACWX and other international stock indexes.

Bottom line: International stock markets beat the pants off US stocks this year and that outperformance looks set to continue in 2026. Money is rotating into less expensive markets and sectors globally as the S&P 500 gets more expensive.

Good investing,

Mike Burnick

Contributing Editor, Market Minute