It looks like the S&P 500 is going to finish out the year the same way it started it. That’s good news for the bulls for the next two weeks. But, it’s bad news as we head into 2026.

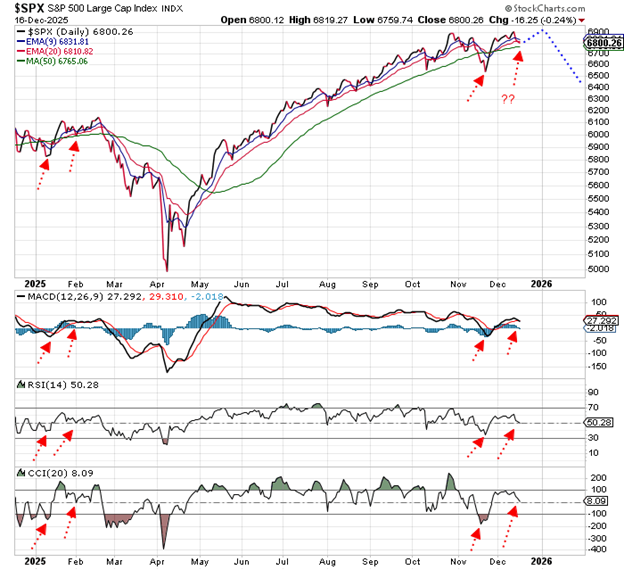

Take a look at this chart of the S&P 500…

The action over the past few weeks is similar to the action at the start of the year. The S&P 500 dipped below all the various moving average lines, and pulled the moving averages into a bearish formation – with the 9- and 20-day exponential moving averages (EMAs) crossing below the 50-day MA. Then, the index reversed and rallied hard enough to pull the moving averages back into a bullish formation.

After a brief decline that caused the index to test the support of its 50-day MA, the S&P went on to rally to a new high by mid-February.

Currently, the market seems to be following that same roadmap. Even the momentum indicators at the bottom of the chart are in the same formation as early this year.

If this action continues, then we could be looking at new highs to finish out the year. That sort of action would also be consistent with the typical bullish seasonal influences during the back half of December.

The problem for the bulls is what comes next.

The decline last January that caused the moving averages to cross into a bearish formation was a warning sign of trouble to come. That trouble played out in March and April as the S&P 500 lost 19%.

Similarly, the recent November decline created a bearish cross in the moving averages. While the market has since recovered, it’s possible that decline was a warning sign of trouble to come. If so, the stock market could be setting up a difficult start to 2026.

Of course, nothing is guaranteed. Stock market history doesn’t always repeat.

But, it does often rhyme. Traders might want to keep that in mind as we close out 2025.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.