It’s time to take profits on bitcoin.

The King of the Cryptocurrencies has had an amazing rally. Bitcoin is up 65% since we first pointed out the potential for a bullish move, back in February. It’s up 12% since we reiterated our bullish stance just over two weeks ago.

Now, though, bitcoin is quickly approaching our upside target and we’re starting to see signs that the rally may be ending.

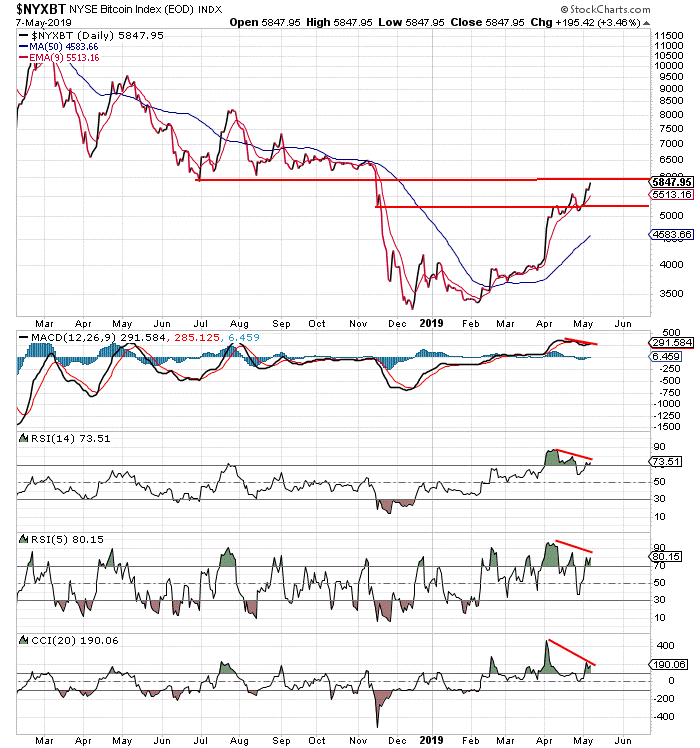

Here’s an updated look at the NYSE Bitcoin Index – which tracks the action in bitcoin…

Bitcoin has rallied all the way back up to where it was trading last November – just before diving off of a cliff. This is a natural resistance area, and it would be normal for the bitcoin rally to pause right here, and maybe even pull back a bit.

Notice also how there is negative divergence on the technical indicators at the bottom of the chart. Negative divergence occurs when a chart makes higher highs, but the technical indicators don’t keep up. They make lower highs.

This is often an early indication that the momentum behind a rally is slowing. Bitcoin has been moving higher. But, it’s not moving higher with as much enthusiasm as before. This usually occurs at the tail end of a rally, and often just before a pullback.

So, with bitcoin now trading at its highest level in six months, with the price bumping into resistance, and with negative divergence developing on several technical indicators, it seems like a pretty good time to lock in some profits.

If you bought bitcoin earlier this year, when we first pointed out the potential for a rally, congratulations. You have a solid gain in just a few short months.

Now, though, it’s time for a pause.

Best regards and good trading,

Jeff Clark

P.S. Before you go, one last thing…

Last week, you may remember me telling you to keep an eye on your inbox for an announcement. It’s a big project my team and I have been working on. Well, it’s just about time for me to reveal the details…

Tomorrow morning, at our normal time, you’ll receive a special Market Minute send from me. In it, I will reveal something I hope will encourage more of you to become option traders.

It’s something I’ve been working on for a while now. In short, it’s a way for anyone to get started trading options. It’s so simple, and profitable, I firmly believe it can help you land an early, comfortable retirement.

So, keep an eye on your inbox tomorrow morning, at 7:30 a.m. ET, for all the details.

Reader Mailbag

In today’s mailbag, one subscriber thanks Jeff for his service…

You made me a better trader and for that, I want to say thanks! I’m still learning… But when all heck breaks out in the market, I’m looking good and that is my peace! Keep sending your thoughts…

– Jeffrey

And another Mastermind subscriber talks about taking emotions out of trading…

I paid attention during the Mastermind course, every time you talked about emotions and trading, and wondered if I’m cut out for this. I try to take my emotions out of it, knowing it’s a rookie trait to be emotionally exhausted from trading. But, I still persist. I think I like selling options instead of buying them. I lose less money that way, and I don’t have to pay constant attention to the market, like I do when I’m buying options.

I still devour every word out of your mouth, trying to get better. But I still need remediation… Thank you for your words of wisdom.

– Racquel

What kind of profits, if any, have you made trading bitcoin? What’s been your strategy with cryptos?

We’d love to hear about your crypto trading stories, along with any other trading questions or suggestions, at [email protected].