Gold and gold stocks are acting well. And that’s probably going to continue for a while.

You see… as the broad stock market started to sell off in October – and it appears, at least to me, the S&P 500 has entered a prolonged downtrend – the gold sector made a bullish move. It now looks like the sector has entered a prolonged uptrend.

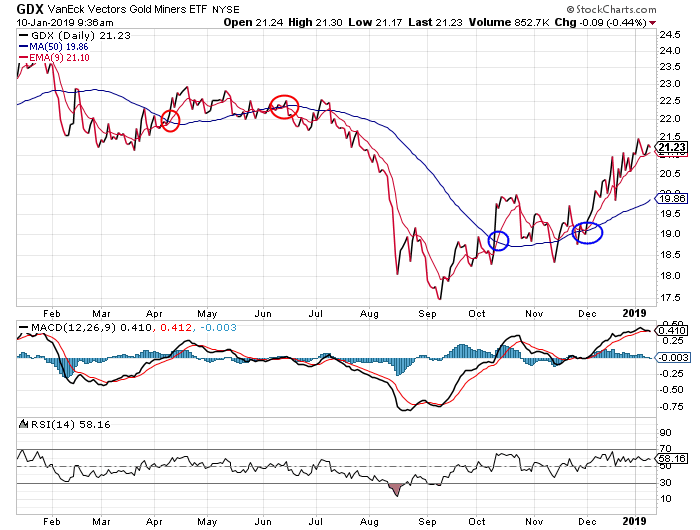

Take a look at this chart of the VanEck Vectors Gold Miners Fund (GDX)…

In early October, GDX rallied above its 50-day moving average (MA) (the blue line on the chart). Even more important, the 9-day exponential moving average (EMA) (the red line) crossed above the 50-day MA as well. This “bullish crossover” often marks the start of an intermediate-term rally phase.

Of course, the buying interest that creates the “bullish crossover” also creates short-term overbought conditions in the stock. You can see how GDX spiked sharply above its 50-day MA in early October. You can also see how GDX traded back down to its 50-day to retest that level as support and to work off the overbought conditions.

Notice, though, how the 9-day EMA drifted back down to the 50-day MA as well. This action usually provides an excellent opportunity to buy a position in anticipation of a rally.

If the 9-day EMA bounces off of the 50-day MA, then the stock is headed even higher. On the other hand, if the 9-day EMA drops below the 50-day MA, then it creates a “bearish crossover.” In that case, traders can then exit their positions for a small loss.

The red circles on the chart show how a similar setup last April-June failed to kick-off an intermediate-term rally.

This time, though, the setup looks good. GDX is a little extended in the short term. The 9-day EMA is a bit too far above the 50-day MA for me to be willing to add more gold stock exposure right here.

But, I would look to buy GDX on a pullback towards its 50-day MA – or if GDX can just chop around for a couple of weeks and give the 50-day MA enough time to rally up towards the current price of the stock.

Best regards and good trading,

Jeff Clark

Reader Mailbag

What’s your take on gold? Do you plan on trading GDX?

And as always, send any other trading questions, stories, or suggestions to [email protected].