Be careful. One of the most consistent indicators I follow is on the verge of generating a broad stock market sell signal…

We came into this week expecting higher stock prices, but also willing to sell stocks into that rally. That seems like an even better strategy today than it did on Monday.

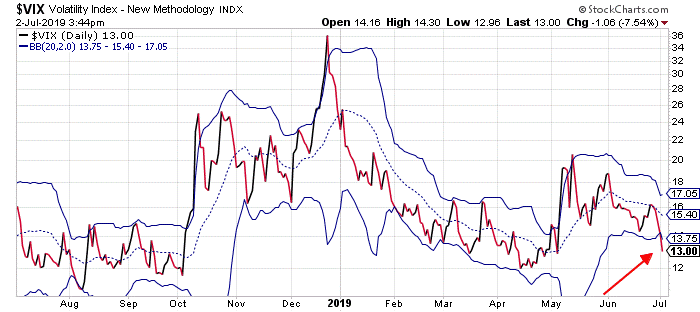

The S&P 500 rallied to a new all-time high on Monday. It added slightly to the gains yesterday. And, in the process of that buying binge, the Volatility Index (VIX) has collapsed.

The Volatility Index (VIX) is commonly referred to as Wall Street’s fear gauge. The VIX rises as investors grow fearful. It falls when investors are complacent.

Extreme moves in the VIX are excellent contrary indicators. As traders, we look to buy stocks when the VIX makes an extreme move to the upside, and we look to sell stocks when the VIX makes an extreme move lower.

Bollinger Bands measure the most probable trading range for a stock or index. Whenever a chart moves outside of its Bollinger Bands, it indicates an extreme condition – either extremely overbought or extremely oversold. Since the VIX is a contrary indicator, it’s best to buy stocks when the VIX is extremely overbought. It’s best to sell stocks when the VIX is extremely oversold.

Longtime readers know we use the VIX to generate trading signals. Buy signals occur when the VIX closes above its upper Bollinger Band and then closes back inside the bands. We get sell signals when the VIX closes below the lower Bollinger Band and then closes back inside the bands.

We’re on the verge of a sell signal right now. Take a look…

The VIX closed slightly below its lower Bollinger Band on Monday. It dipped even farther below the band yesterday. When the VIX rallies and closes back inside the bands – maybe today, maybe Friday – we’ll have our sell signal.

So, as I mentioned on Monday, traders should use the rally this week as a chance to take some profits off the table. We’ll probably have a chance to put money back to work at a lower level sometime over the next few weeks.

Best regards and good trading,

Jeff Clark

Editor’s note: Have you submitted your questions for Jeff’s Open Line Q&A?

Your chance to hear Jeff’s unfiltered market insights only comes around a few times each year. Whether you’ve never placed a trade before… Or you’re an option trading veteran… What Jeff says at this Q&A will help you prepare for a market crash – which he sees coming as soon as this year.

Keep an eye on your inbox for info on how to access the Q&A. And remember, to get your questions to the top of the list, submit them in advance right here…

Reader Mailbag

How will you trade the VIX sell signal? Or, do you think volatility will fall further…?

Send in your thoughts – along with any other questions or comments – to [email protected].