Jerome Powell will not lower interest rates.

It’s not because the Fed Chairman is a numbskull, or a dumb guy, or a total and complete moron – as President Trump has alleged.

It’s because Mr. Powell is handcuffed.

By lowering short-term interest rates, the Fed will push long-term rates higher. And, that’s something the U.S. can’t afford to have happen right now.

Let me explain…

The Fed sets the target for the Fed Funds rate – the rate of interest banks charge each other on overnight loans. The current target rate is 4.25-4.50%. President Trump would like to see it somewhere closer to 2%.

The problem is, the Fed can’t simply decree a 2% Fed Funds rate and have it magically happen. In order to change the rate, the Fed has to engage in open market operations.

In other words, the Fed needs to go into the open market and either buy or sell short-term debt in order to reach its target rate. If the Fed wants to lower rates, it has to buy enough short-term debt to push the price higher so that the yield comes down.

In the days of Quantitative Easing (QE), this was easy. The Treasury would print money, give it to the Fed, and the Fed would buy Treasury bills. The price of the bills would go up. The yield would come down. The Fed would hit its target.

But, printing money causes inflation. The Fed doesn’t want that anymore. So, we stopped the whole QE fiasco in 2022 (after 14 years of it!!!).

So, where does the Fed get the cash to buy the Treasury bills now? It has to sell other securities in its portfolio – specifically, longer-term bonds. And, by selling bonds, the Fed pushes the price of those bonds down which forces the yield higher.

In other words, by lowering short-term rates, the Fed causes long-term rates to rise.

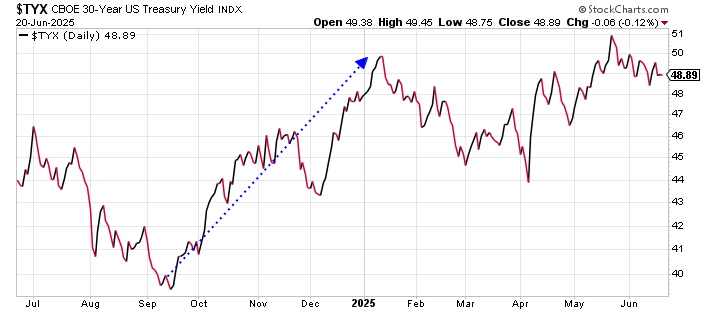

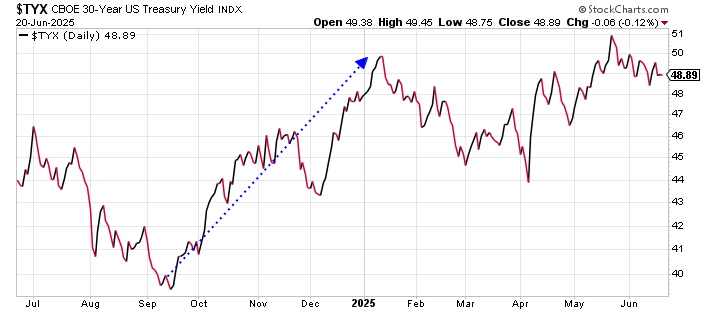

For proof, we only need to look at what has happened to the yield on the 30-year Treasury bond since the Fed started lowering its Fed Funds rate last September…

Last September, the Fed lowered its Fed Funds target rate by 0.50%. The Fed cut rates by another 0.50% by the end of 2024 – lowering the Fed Funds target by a total of 1%.

But long-term rates went up. The yield on the 30-year Treasury Bond was less than 4% in September. It hit nearly 5% by January.

In the absence of Quantitative Easing (QE), lowering short-term rates causes long-term rates to rise. The US cannot afford that to happen right now because…

…The national debt just surpassed $37 trillion. Twenty-five percent of that debt comes due in the next few months. It has to be refinanced.

So, the government has to issue $9 trillion in long-term debt just to pay off the debt that is maturing over the next few months.

You can see the problem here. If the Fed lowers short-term rates, the cost of refinancing long-term debt will be higher.

Chairman Powell knows this. There is no way he’ll be lowering rates until this glut of refinancing is out of the way.

President Trump knows this, too. But, by publicly chastising the Fed Chairman, he can divert attention away from a potential debt crisis.

And, he’s created a handy scapegoat just in case things go south.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.