Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been a senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Four Stocks to Consider in the Oil Patch

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Stocks have enjoyed a stunning rebound off the April lows, with the S&P 500 Index up over 18%.

But there’s one sector that’s been left entirely left out…

Energy stocks.

In fact, investing in the oil patch has been a total disaster for a long time now. The SPDR S&P 500 Energy ETF (XLE) is down 9% over the last three months alone.

Oil and gas drilling and exploration stocks are performing even worse, down 11.6% over three months, and nearly 18% in the past year.

But while energy stocks may be widely despised by investors right now, they’re also dirt cheap and money has just started flowing back into the sector.

That combination gets my attention every time.

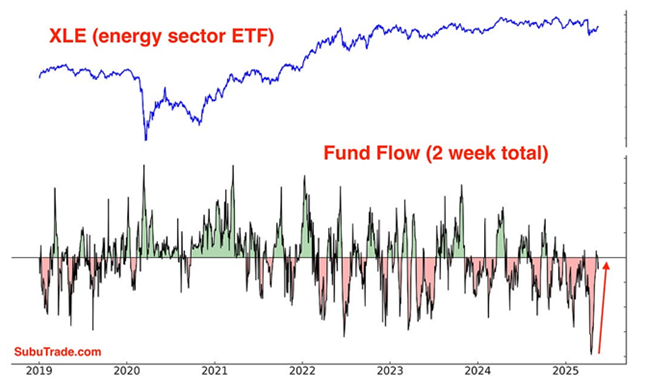

First, retail investor flows have been negative all year, with an estimated $5.7 trillion flowing out of XLE year-to-date.

But as you can see above, those money outflows have quickly stabilized. And this could be just the start of a big reversal for money flows back into energy.

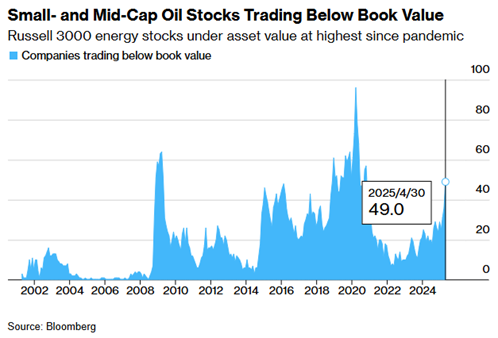

Second, Bloomberg recently reported that “a third of all mid- and small-cap oil and gas stocks in the U.S. are now trading below book values.”

That’s unheard of outside of a severe recession.

But you can look it up, as I did. And sure enough, XLE stock holdings trade at an average 1.9x book value today.

That’s quite a bargain, considering the average stock in the S&P 500 trades at over 5x book.

So, I took a deeper dive into energy with our TradeSmith Finance database, and I found 41 oil and gas stocks we track trading below 1-times their book value!

However, most of them are in the health indicator red zone, which means these stocks are likely to underperform, and you should avoid them until their health and trends improve.

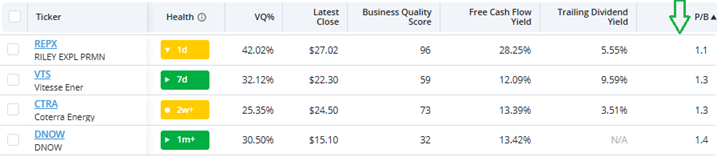

Taking another pass using our TradeSmith Screener, I searched for stocks with a price-to-book ratio below the sector average of 1.9x for XLE.

I also screened out any red zone stocks, according to our health grade filter, and found 12 results.

The top four, ranked by lowest price-to-book value are shown below.

Mike Burnick’s Bottom Line: Energy stocks have been out of favor, but they’re also cheap based on book value. Plus, it appears the heavy selling of energy stocks has run its course. Savvy investors are moving money back into this unloved and undervalued sector. Keep your eye on the oil patch for fresh buying opportunities.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.