September came and went without so much as a downside peep, much less a full-blown pullback.

The worst month of the year for the stock market didn’t live up to its bad reputation, with the S&P 500 up 3.5% last month. Meanwhile, the tech-heavy Nasdaq gained 5%.

But now that the worst month for stocks is over, and the best three-month stretch lies ahead, it may still be a wise move to keep a defensive posture just in case.

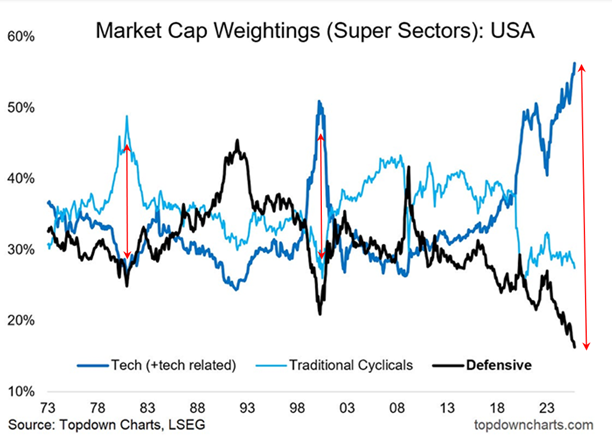

Right now, the gap in the market cap weight between technology-related sectors and defensive sectors in the stock market has never been wider. Not just before the dot-com bust in 2000, and not on the eve of the mini-tech crash from 1979-1981.

Big gaps like this have always happened around key turning points in the stock market.

Tech gets extremely expensive near market peaks. And defensive sectors get extremely cheap at the same time. In other words, the tech sector today is an expensive, crowded trade, while the defensive sectors (consumer staples, healthcare, and utilities) are cheap and hated by investors.

And that’s where profit opportunity is waiting for savvy investors.

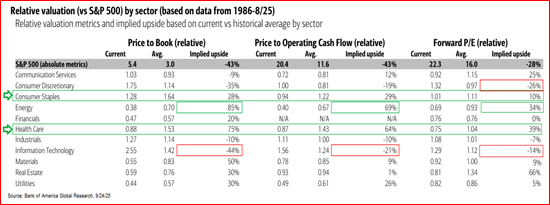

Just how cheap are these defensive sectors relative to the stock market?

They’re dirt cheap today, according to Bank of America Global Research, and as a result they have huge upside potential… especially healthcare and consumer staples.

As you can see, the current relative valuation (compared to the S&P 500) for both staples and healthcare (highlighted in green) are among the cheapest for any of the S&P 500 sectors.

- The current price-to-book ratio for healthcare represents implied upside potential of 75%, while the price-to-cash flow metric for this sector implies 64% upside.

- For staples, its price-to-cash flow indicates 29% upside and price-to-book implies 28% gains from the current price.

Energy and utility stocks also have good upside potential based on these metrics. Meanwhile, the technology sector (highlighted in red) is the most overvalued sector across the board.

In fact, tech’s price-to-book value indicates -44% downside for the sector!

Bottom line: For ETF investors, there are two easy ways to take advantage of the potential upside in healthcare and staples: SPDR Select Sector Health Care ETF (XLV), and SPDR Select Sector Consumer Staples ETF (XLP), respectively. And XLV just started a strong uptrend, jumping nearly 7% in the last four trading days alone.

Good investing,

Mike Burnick

Contributing Editor, Market Minute