Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Higher Yields Are a Strong Headwind for Stocks

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

A big headwind for the stock market right now is rising interest rates.

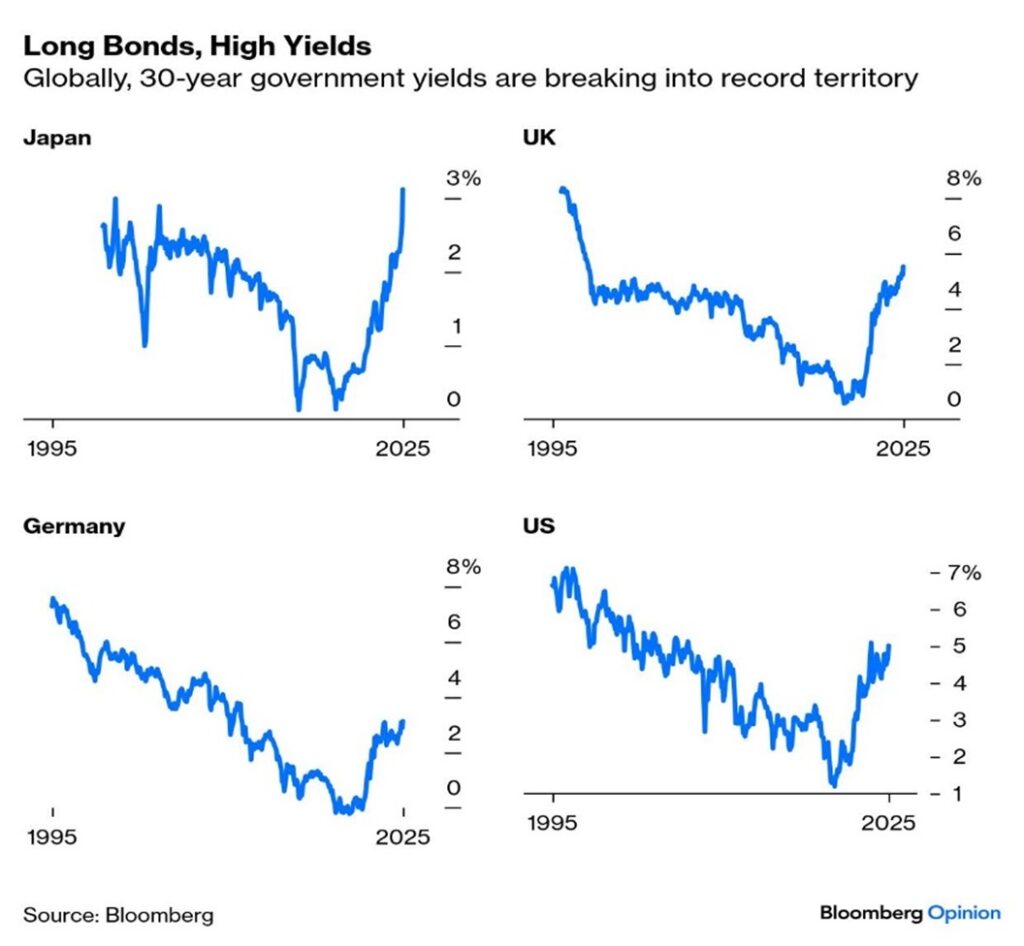

Last week, the 30-year US Treasury bond yield rose above 5% for the first time in 18 years. And the rising rate trend isn’t only a US problem.

Higher yields are going global, as you can see here, with rising interest rate trends in Europe and Japan as well.

And the trend has a lot to do with rising fears of inflation, due mainly to the rising costs of global trade. Tariffs, after all, are a tax that makes commerce more expensive worldwide.

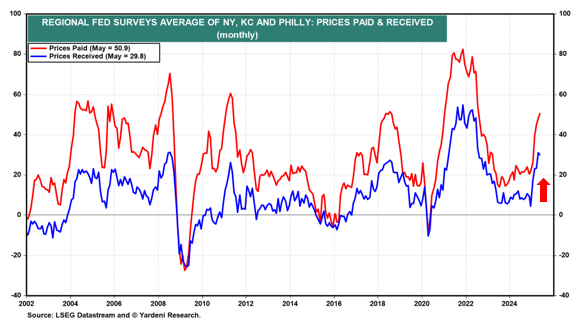

This is already showing up in some of the hard data. For example, regional data from the Fed shows that prices paid are on the rise for US businesses.

Coupled with slowing first quarter economic growth, this is a recipe for stagflation. Higher inflation along with slow (or even no) growth. And in the past, that’s proven to be a toxic combination for the stock market.

When Walmart (WMT) recently warned that it may raise prices due to higher tariff costs, the White House suggested Walmart should “eat the tariffs.”

The reality is that retailers, even giants like Walmart, operate on thin profit margins. And that’s true for many businesses, at least outside of technology and a few other industries.

If businesses hold the line on prices in the face of rising costs it means plunging profit margins. That’s a bad business model that results in lower stock prices.

The bottom line is that higher interest rates and inflation – or even worse stagflation – is a double-whammy for the stock market.

First, inflation and higher costs will eat away at profit margins for S&P 500 companies.

Second, higher yields will raise the discount rate on every dollar of future corporate profits, pressuring the valuation for stocks lower.

Mike Burnick’s Bottom Line: Stocks have rebounded strongly from the April low, as the full impact of tariffs were temporarily postponed. But with trade negotiations still unresolved, plus yields and inflation costs on the rise, this rally may be living on borrowed time.

Good investing,

Mike Burnick

Contributing Editor, Market Minute