Managing Editor’s Note: Investing brothers Andy and Landon Swan have a stock-picking technique that is so innovative, it’s been studied by top academics at Georgetown.

The idea behind it is simple – and brilliant: Find massive cultural and consumer shifts as they develop, identify the best-of-breed brands benefiting from this shift that consumers love, buy the stock before the crowd catches on, and hold as long as they remain hugely popular with consumers by tracking millions of individual data points from across the web.

And when the Swan brothers recently met Louis Navellier – the “King of Quants” – they realized their systems have a lot in common… including homing in on winners.

This led them to team up and create “The Ultimate Stock Strategy.”

And on Tuesday, October 28 at 10 a.m. ET, they’ll be unveiling this new way to invest that history shows can work in EVERY kind of market you can imagine – up, down, or flat.

So make sure you reserve your spot right here, then read on to learn more about how it all works together…

How a Day With the “King of Quants” Led to the Ultimate Stock Strategy

BY ANDY SWAN, FOUNDER, LIKEFOLIO

It’s amazing how much you can learn from spending the day with a fellow investor.

Especially when it’s someone who’s been doing it professionally for 45 years…

…whose quantitative system has topped the performance of the S&P 500 since 1997…

…someone whose investment firm manages around $1 billion in assets…

…and whose mutual funds and ETFs have been ranked #1 by Morningstar and the Wall Street Journal.

That someone is Louis Navellier. And meeting him lit the fuse on an exciting new collaboration.

You may know the name.

He’s a regular guest on Bloomberg Television, Fox News, and CNBC.

Louis began programming computers that beat the market in the 1970s while still a student. And he launched his first newsletter in 1980, back when Landon and I were still learning how to walk.

That’s Louis on the left beside Landon (in the middle) and me

He’s a living legend among quant investors like us – folks who rely on data, not guesswork, for their edge. That’s why they call him the “King of Quants…” And why The New York Times dubbed him an “icon among growth investors.”

He’s been doing this longer than anyone else we know.

And when he shared how he got into this business, it sparked a collaboration that led to our Ultimate Stock Strategy. It’s a rule-based system that on average would have found a new stock every six trading days with the potential to double your money.

I’ll get into the details in a moment – plus how you can learn more. First, let me share a little bit about how Louis blazed a trail for us quants.

This System Grades 6,000 Stocks

It all started with an assignment Louis got as a student.

He was studying finance at Cal State Hayward. One of his professors there had a consulting gig with Wells Fargo. He invited Louis to help him run some models using the bank’s mainframe.

Louis was tasked with building a model portfolio of 320 stocks that would track the returns of the 500 stocks in the S&P 500.

Only his portfolio didn’t just mimic the performance of the index – it beat it.

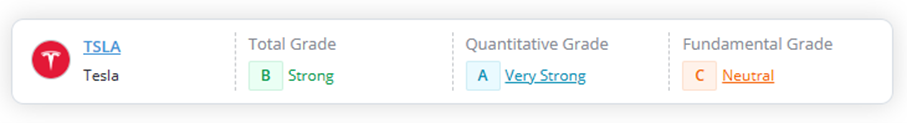

It was the foundation of the Stock Grader system he uses today. It ranks more than 6,000 stocks based on sales growth, operating margin, earnings momentum, and other fundamental metrics. Then it combines this ranking with institutional buying and other catalysts.

It all gets boiled down to a grade, just like you’d get in school:

- A stock with the highest growth and business quality ratings gets an “A.”

- A stock with miserable ratings gets an “F.”

Since Louis started his first newsletter in 1980, this system has flagged 676 stocks that could have doubled your money or more – including 22 that shot up 100 times in value.

Louis proved that a rules-based system combining fundamental analysis market flows could systematically beat the index.

Our breakthrough was proving that consumer behavior online could, too.

Our Own Eureka Moment

An assignment during our time at TD Ameritrade inspired a deep dive into Twitter (now X), which led to a eureka moment:

- Consumers enthusiastically share the brands they purchased on social media

- We found a way to use that data to forecast the sales of the companies that own those brands

- We use those forecasts to spot outlier stocks

Once this lightbulb went off, we knew we were sitting on a real edge. We secured an endorsement from Georgetown University with a study that proved our technology could “predict” future outcomes. We founded LikeFolio to give our brainchild life. And in 2019, we partnered with TradeSmith to bring our data-driven edge to thousands of everyday investors just like you.

The LikeFolio playbook is simple:

- Find massive cultural and consumer shifts as they develop

- Identify the best-of-breed brands benefiting from this shift that consumers love

- Buy their stock before the crowd catches on

- Hold as long as they remain hugely popular with consumers

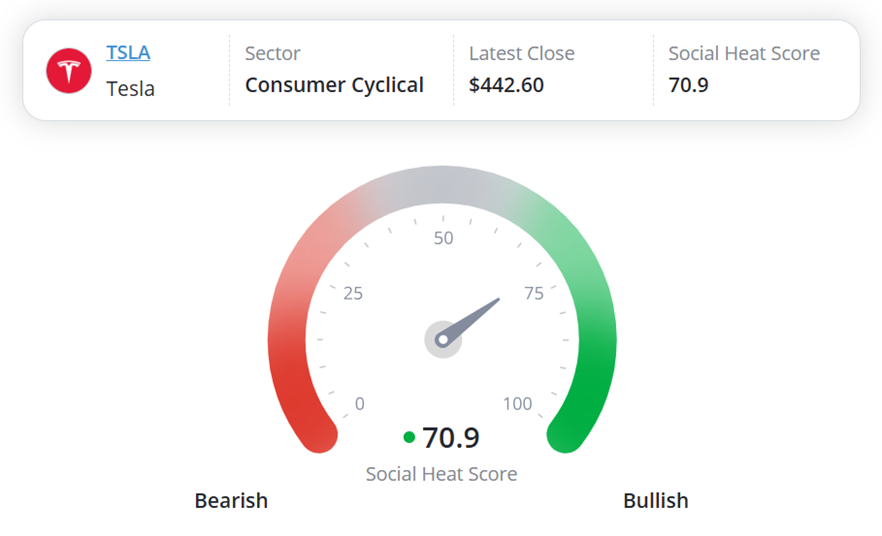

We track millions of individual data points from across the web – from social media posts to AI queries, search, and web traffic trends. Then we distill it into a 0 to 100 Social Heat Score to spot the stocks ready for liftoff.

A stock with a Social Heat Score above 70 indicates a “buy.” A stock with a Social Heat Score below 30 indicates a “sell.”

It’s not far from what Louis does with his Stock Grade system. Only it uses online sentiment as its main measures instead of growth and business quality ratings.

After meeting Louis, it didn’t take long for us to realize we had many winners in common. And when we looked into it some more, we realized that combining our consumer insights with Louis’ grading system would further sharpen our edge.

We weren’t wrong. In our testing, this “ultimate strategy” spotted more than 240 double-your-money opportunities over a span of five years for an average gain of 244%.

Hundreds of New Potential Doubles

This new strategy marries LikeFolio’s Social Heat Score with Louis’ Stock Grader system to create something even more powerful.

And that’s saying something…

Landon and I have delivered 25 double-your-money-or-more winners to our subscribers in just the past five years, spotting stocks like:

- At Home Group (HOME) during the COVID pandemic before it shot up 611%.

- Coinbase Global (COIN) in the wake of the 2022 crypto market crash before it rocketed 445%.

- And more recently, Robinhood Markets (HOOD). It soared 556% in under 17 months after our system flagged it to us.

And Louis’ list of top gains includes many of the most legendary winners of recent memory.

- Like Apple (AAPL), which Louis’ system flagged in 1988 – nearly two decades before its first iPhone and ahead of a run that took it as much as 36,000% higher.

- Or com (AMZN), which Louis’ system flagged in 2004 before it soared 8,151%.

- Or Netflix (NFLX) in 2009 before it shot up 7,749%.

Louis’ Stock Grader even pointed to Nvidia (NVDA) in 2005, ahead of its epic 44,000% climb to become the largest company in the world.

More recently, he’s made his subscribers 338% on Enphase Energy (ENPH), 151% on Ceco Environment (CECO), 197% on UFP Technologies (UFPT), and racked up more than a dozen more double and triple-digit winners on top of that. All in the last two years.

And those gains are before you combine our two strategies.

The Ultimate Stock Strategy could add hundreds of new doubles to that list of winners. More important, it could add zeroes to our subscribers’ net worth.

Louis, Landon, and I will be revealing all the details during a special event next Tuesday, October 28, 2025, at 10:00 a.m. ET.

I hope you’ll clear some time in your schedule to join us. The holidays are around the corner. And we aim to deliver at least one more stock that doubles by Christmas.

RSVP right here.

Until next time,

Andy Swan

Founder, LikeFolio

P.S. As a thank-you for joining, we’ll be giving every attendee one stock pick vetted by yours truly, another vetted by Louis, and one stock we all agree you should sell immediately. Here’s that link again to secure your spot.