As I said Wednesday, I’ll be showing you how I would trade Microsoft using options.

Remember, options will help you get exposure to your favorite stocks… with lower risk and higher reward potential.

And I decided the best way to show you would be with our first video edition of 2026.

Check out my video below or scroll down to read the transcript, and remember to send your thoughts – good or bad – to [email protected].

Transcript

Hey, good morning folks. Welcome to the very first video edition of Market Minute for 2026. I decided that today we would do a video version of Market Minute because as I mentioned on Wednesday, we’re to take a look at Microsoft and I was going to show you today how I would trade options on Microsoft.

On Wednesday, we talked about just using a basic call option strategy in lieu of buying the stock and how that would increase your rewards and reduce your risk.

And then I mentioned that I thought on Friday, today, we would take a shot at how I might actually trade Microsoft. So that’s what we’re going to do.

Now I’ll mention that I am recording this on Wednesday evening. The market’s closed, obviously, and all of the prices on everything that I’m referencing here are going to be as of Wednesday. So they might be a little bit different by the time you actually read this. So let me share my screen, and I can show you what I see in Microsoft.

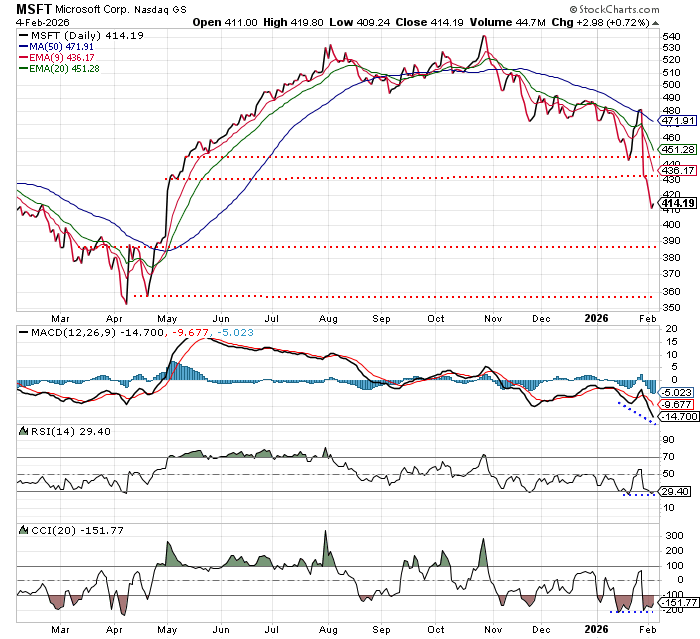

So here is a chart of Microsoft. So this is an interesting situation here. You’ve got Microsoft, which has clearly been in a downtrend since it peaked back in October, and it’s trading below all of its various moving average lines.

And you can see the various moving average lines are starting to expand pretty far away from each other. Now, Microsoft itself, at $414 a share, is trading quite significantly below its 50-day moving average, which is up here around $472, and it’s broken a couple of support levels.

The next obvious support level doesn’t come in until, gosh, down around $$390 a share. So there’s still some downside that we can expect Microsoft will probably get hit with. It’s not a guarantee that it’s going to head down that way, but when you look at how it sliced through the first support level here at $450, and then it sliced through the second support level here at $430, the next support level is all the way down here because that rally back in May back last year that created this little range there was no correction in the meantime, it was basically just a straight up move.

And the problem when you have straight up moves is, when and if a stock comes back into its zone, this is sort of like an air pocket, so there’s a pretty good chance we’re going to make a straight down move toward this $390 level. So at this particular point if I’m looking at this chart and I’m going to make a recommendation, I can’t recommend buying call options on Microsoft simply because it’s too far away from this bottom support line. It doesn’t mean the stock can’t bounce a little bit here, but any bounce is probably not going to hold for very long.

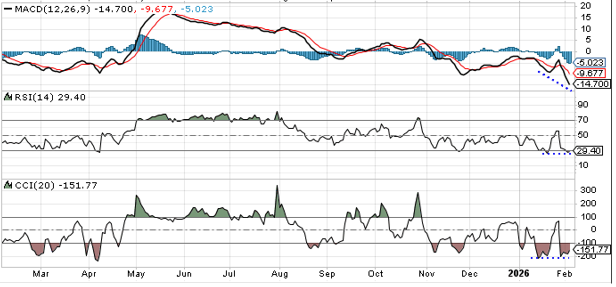

And I say that because if you look down at the momentum indicators at the bottom here, the MACD indicator, the RSI, that’s the Relative Strength Index for a 14-day period, and you’ve got the CCI, all three of them are making lower lows right along with the stock.

So there is no positive divergence.

We talked about positive divergence before. And that’s typically when a stock is making lower lows, but the momentum indicators are making higher lows. That tells you that there’s probably a change about to occur, that the momentum behind the decline is starting to wane a little bit, and the stock’s ready to pull up a little. That’s not what we’re seeing here.

We’re seeing basically this decline in Microsoft, as bringing the stock down to lower lows and it’s bringing all the momentum indicators down to lower lows, so it’s unlikely the stock is going to just, on a dime, turn around and start a rally phase again. More likely if it does bounce a little bit from here, you know you’ve got resistance up at $430 here, maybe it can rally back up that level and it needs to rally up strong enough to pull these indicators off the bottom that way when it comes back down one more time these indicators can then make higher lows and we’ll get the of positive divergence that I like to trade into. So at the current moment, I couldn’t recommend call options on this stock simply because it looks to me like Microsoft has further to go on the downside.

Again, that’s not a guarantee, but I’m just saying from my trading perspective, I couldn’t recommend buying call options here. The alternative when you face a situation like this, if you truly like the idea of owning Microsoft and you’re willing to buy it, maybe down here at that $390 level. If you wait for it to get to $390, one of two things can happen.

Either it never gets there because the stock all of a sudden turns around and starts to rally right away, and you would have missed the chance to buy it here around $414, or it gets to $390 where you wanted to buy it in the first place, but it happens in such an aggressive fashion where the selling pressure is so much that you wig out and you can’t place that trade.

And that happens a lot. A lot of times people go, my goodness, I’ll just wait for a nice little pullback in the market before I jump in. And then that pullback happens, and it happens in such a violent fashion that you can’t pull the trigger on a trade. It happens all the time. So one of the ways to get around that is possibly by selling uncovered puts at the strike price at which you are willing to buy the stock. So for example, if you like the idea of owning Microsoft, and you think it’ll hold support down here at this $390 level, why not sell an uncovered put with a strike price of $390. So let me share with you that part of my screen.

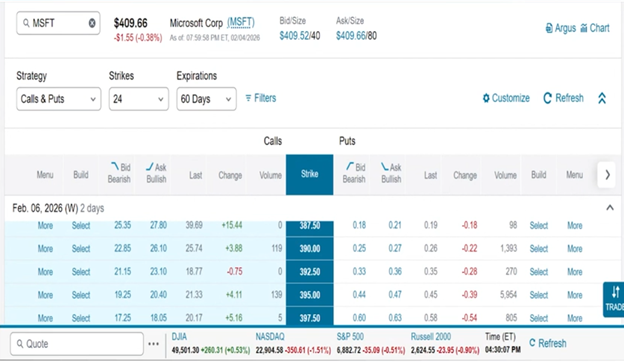

All right, so this is an option string on Microsoft.

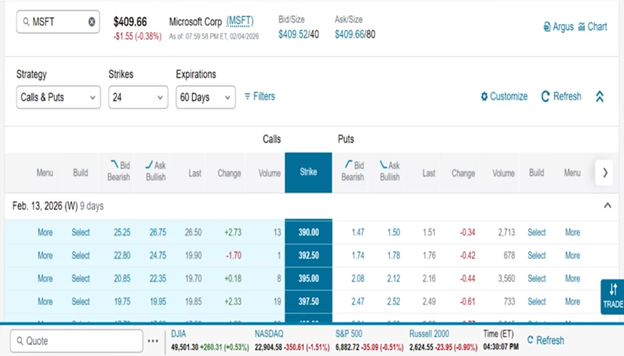

If I’m looking at maybe selling an uncovered put at the $390 strike price, I go down here and I look, I see the February 6 contracts. These are the ones that expire on Friday, February 6th, which I’m recording this on Wednesday, but you’re going to see this on Friday morning. They’re only trading for 25 cents. I’m not going to get much of a benefit to sell those uncovered puts. But if I go down a little bit and I go out maybe to next week, let’s go to the 13th and see what happens.

So on the 13th, the $390 puts, I can get a buck and half. And if the stock falls a little bit on Thursday or on Friday, maybe I can get a little bit more than that. Now the idea behind selling uncovered puts, understand what we’re doing here. We’re basically going to agree to buy the stock at this $390 strike price if Microsoft closes at or below that level on February 13th. And for that, we’re going to get paid $1.50, right? That’s where the option is trading currently.

This is kind of like getting paid to trade if you will. Now think about it in shopping terms. If you go into Neiman Marcus and they’ve got a sweater and the sweater costs 420 bucks. You say, I can’t possibly pay $420 for it, but boy, if it ever goes on sale for like $390, I’d certainly be interested in buying it. And in fact, if it goes on sale for $390 between now and the next week, I’d be interested in buying it.

And then you go up to the cashier and you say, “okay, look, if this sweater goes on sale for $390 bucks, I’m willing to buy it.” The cashier goes into the register, pulls out a buck and a half, gives it to you, and you walk away.

That’s sort of what selling uncovered puts is. And that way, if that sweater comes down in price to $390, you’re buying it for $390, you got paid ahead of time to make that agreement. If it never goes down to $390, at least you got a buck and a half out of it.

So in the case of Microsoft, if we agree to buy the stock at $390 a share, if it closes below that level on February 13th, we get paid today 150 bucks, a buck and a half a share. That’s not a lot, but the stock is relatively far away from the strike price. If the stock gets closer to that strike price, in other words, if we go back to the chart here and you see Microsoft gets maybe down to the $400 level, those options are going to inflate enough to where it starts to become interesting to sell an uncovered put option on that. So that’s what I would be looking to do here. I’m not looking to buy calls just yet.

I am looking though, if we can get closer to this support line, maybe selling an uncovered put. And the number one rule about uncovered put sales though, is you have to be willing to buy the stock at the price you’ve agreed to. If you don’t want to own Microsoft at $390, if you think there’s a really good chance you can get all the way down to $360, then you don’t sell the $390 uncovered put.

If you don’t want to own Microsoft at all, you don’t sell any uncovered put on it because there is a chance that you wind up owning the stock. I will tell you, when the market fell apart last April, right, we had that big decline from February to April, in late March, I sold an awful lot of uncovered puts on a whole bunch of different stocks.

Stocks like Advanced Micro Devices, Google I sold puts on, I sold puts on Target, I sold puts on a handful of stocks that I wanted to own at prices that were well below where they were trading in the market at the time.

But because that decline was so severe in March and into early April, I got assigned to buy in every single one of those stocks. The great thing about that was, remember what I said earlier, if you like the idea of buying it here, if it gets down to that price, you might not be able to pull the trigger because you’re freaking out a little bit from it.

I was obligated to buy those stocks at the prices I was willing to. I wound up getting assigned on them and all three of those stocks that I just mentioned and all of the stocks that I sold uncovered puts on traded sharply higher in the weeks after that.

So I wound up, in a way, being forced to take a profit. So that is, I guess, one of the good things about selling uncovered puts in a volatile situation. If you want to own those stocks anyway, you wind up getting paid to place those trades and then you wind up forced to execute that contract the way that you were going to in the first place. So there’s a good thing about that.

Again, if you’re not interested in owning Microsoft, you don’t sell uncovered puts on Microsoft.

You only sell uncovered puts on stocks that you want to own at the prices that you’re willing to pay. So at the moment, the way that I would trade Microsoft, I wouldn’t be looking at buying call options on it. As it gets closer to $390, that becomes more of a possibility.

Right now, I’m looking for an opportunity maybe to sell uncovered puts on Microsoft, again, as it gets closer to that $390 level and those puts inflate a little bit. So we’re leaving it at that.

That’s how I would trade Microsoft myself. Next week we’ll look at a couple of other situations that you folks have written in about.

And if you have any questions or comments or anything you want me to take a look at, just hit that feedback button and send me a note at [email protected].

Have a wonderful trading day and we’ll be back on Tuesday. Talk to you then. Bye bye.

Best regards and good trading,

Jeff Clark

Editor, Market Minute