Managing Editor’s note: On Tuesday, Andy and Landon Swan and the “King of Quants” Louis Navellier, launched a new collaboration they’re calling the Ultimate Stock Strategy.

It’s a new system that combines two of the world’s most powerful data-driven strategies. And in backtesting, it flagged more than 240 double-your-money opportunities over a span of five years for an average gain of 244%.

You can check out the launch right here. You’ll discover how this system not only identifies powerful market megatrends, but also the best stocks to play them.

Then read on below for more from Andy on one of the megatrends he and Landon are tracking right now – what they call the AI Power Crunch. If it doesn’t get solved, then the “miracles” promised by AI simply won’t happen.

How to Profit From the AI Power Crunch

BY ANDY SWAN, FOUNDER, LIKEFOLIO

Last month, OpenAI founder Sam Altman said something that stopped me cold:

“Maybe with 10 gigawatts of compute, AI can cure cancer. Or with 10 gigawatts, AI can tutor every student on Earth. If we’re limited by compute, we’ll have to choose which one to prioritize… so let’s go build.”

Ten gigawatts. That’s ten nuclear reactors’ worth of “compute,” or processing power – just to keep the world’s smartest machines thinking.

It’s the most vivid reminder yet that AI’s biggest constraint isn’t algorithms, or even data. It certainly isn’t imagination, either.

It’s electricity.

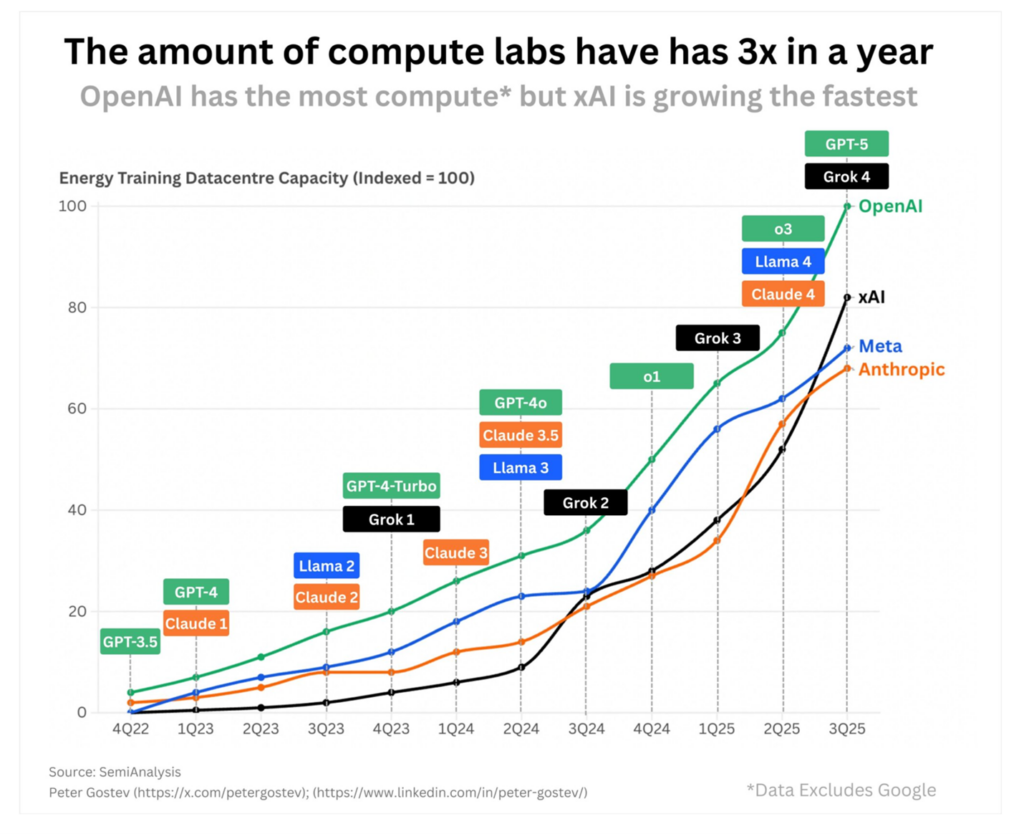

Since OpenAI launched ChatGPT to the public in late 2022, AI adoption has exploded faster than any technology in history.

OpenAI now serves 700 million weekly users, and compute demand at leading labs has multiplied 100-fold in just three years.

Every question we ask these models – every image we generate, every chatbot conversation – spins up trillions of calculations. Each of those calculations burns power and generates heat.

Multiply that by hundreds of millions of users and you get to a simple truth: The AI boom is running straight into a wall of physics.

We’re now entering what I call the “AI Power Crunch.”

It’s the point where the digital world collides with the physical limits of chips, cooling, and the electrical grid itself.

This is a massive profit opportunity for folks who understand what’s going on.

Big Tech’s $400 Billion Panic

Wall Street’s been focused on who’s winning the AI “arms race.” But look where the money is really flowing.

Combined capital spending by Microsoft (MSFT), Meta Platforms (META), Google (GOOGL), and Amazon.com (AMZN) is set to double from roughly $200 billion in 2024 to over $400 billion by year end – and most of that surge is going into data centers and GPUs, not new apps.

Meta alone has boosted data-center investment to $72 billion this year.

Nvidia (NVDA) and OpenAI have announced a $100 billion buildout of new supercomputing capacity – the equivalent of 10 nuclear reactors in power draw.

We’re no longer talking about server rooms.

We’re talking about industrial-scale compute – data centers the size of football stadiums that consume as much power as small cities.

And here’s the thing: All that capital is still not enough.

Training an AI model is a one-off cost. But inference – the constant serving of answers to billions of users – never ends. It’s like paying rent forever.

Gartner now warns cloud bills can overrun budgets by 500-1,000% when companies underestimate AI usage.

That’s why tech giants are racing to build their own chips, optimize cooling, and buy power capacity years in advance.

Every link in that chain, from chips to memory to power delivery, is under pressure. And every pressure point creates a new class of winners.

The Holy Trinity of Compute

Let’s talk about the three companies I’m watching most closely in this power race.

Much like the railroads did the for the Industrial Age, these companies form the backbone of the AI Age we’re entering now.

Everyone has heard of Nvidia. It’s the world’s most valuable stock and the biggest player in AI compute.

Its existing chips power an estimated 70-95% of global AI capacity. And its new H200 chips push performance to levels that used to sound like science fiction.

But Nvidia doesn’t just make chips. It also builds the software and networking stack that tie entire data centers together.

That’s why, even after tripling in revenue to $130 billion, the company still can’t meet demand.

Another AI Power Crunch stock I’m watching closely is Micron Technology (MU).

AI chips are useless without ultra-fast memory feeding them data.

That’s where Micron comes in.

Its HBM3E memory (that stands for “high-bandwidth memory”) is the pipeline that keeps AI chips from stalling.

By mid-2025, Micron had already sold out its entire 2024 and most of its 2025 production – before it even shipped.

And perhaps even more interesting is Nvidia rival Advanced Micro Devices (AMD). It isn’t trying to out-muscle Nvidia – it’s trying to make AI cheaper to run.

Its MI300X accelerator holds a massive 192 GB of high-bandwidth memory, allowing AI models to run without constantly swapping data in and out. That means faster responses and lower cost per query – crucial as inference bills pile up.

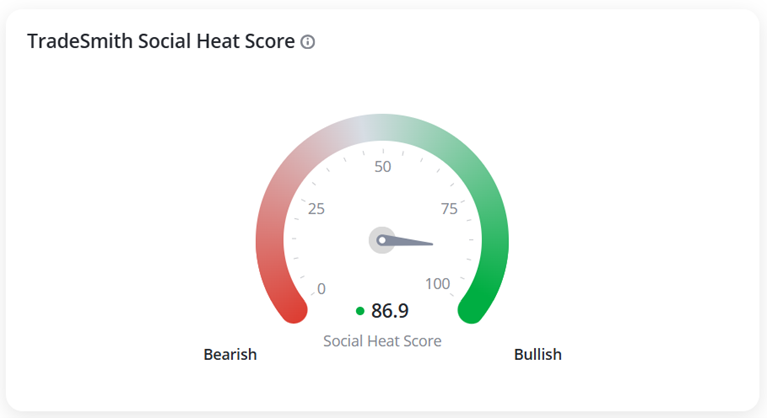

AMD is developing mission critical technology. It’s also lighting up on our Social Heat Score.

AMD’s Social Heat Score: 86.9 out of 100

The Social Heat Score distills millions of consumer data points from across the web – social media, search trends, and more – into one simple number, 0 to 100.

We target stocks with Social Heat Scores above 70. The higher, the better. This reveals what brands, products, and companies are doing well with consumers on Main Street – sometimes well before Wall Street catches wind.

AMD currently logs an impressive 86.9 out of 100. That’s a clear buy signal.

Meta and Microsoft are already deploying AMD chips in their data centers, proving its importance in the race to make AI profitable.

Together, these three form the backbone of the modern compute economy.

We’ve Seen This Movie Before

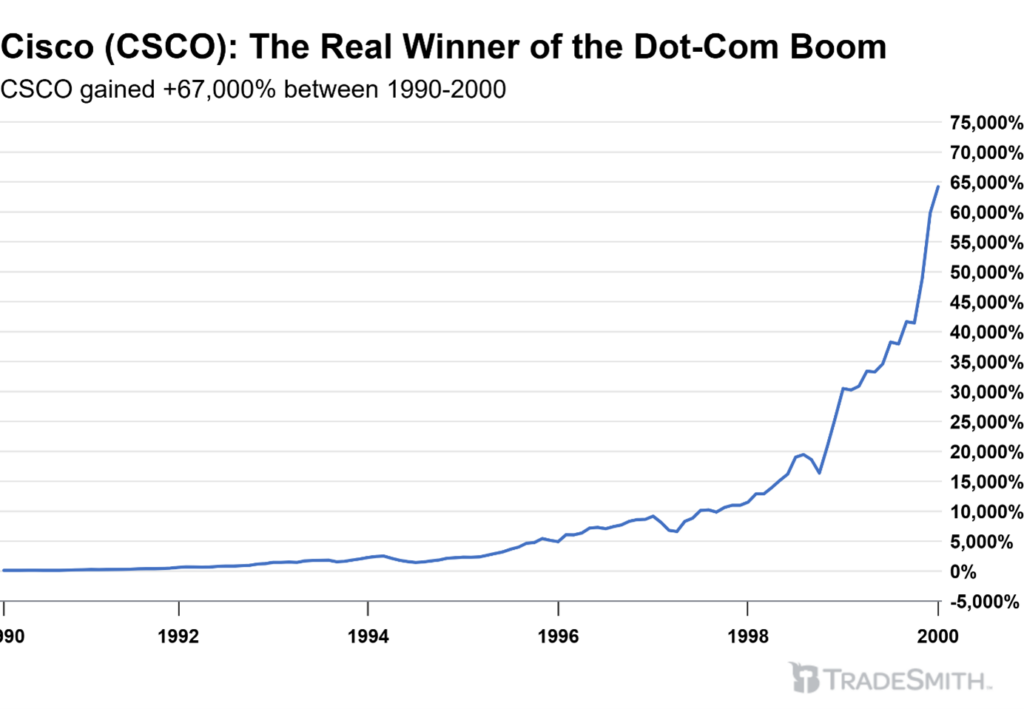

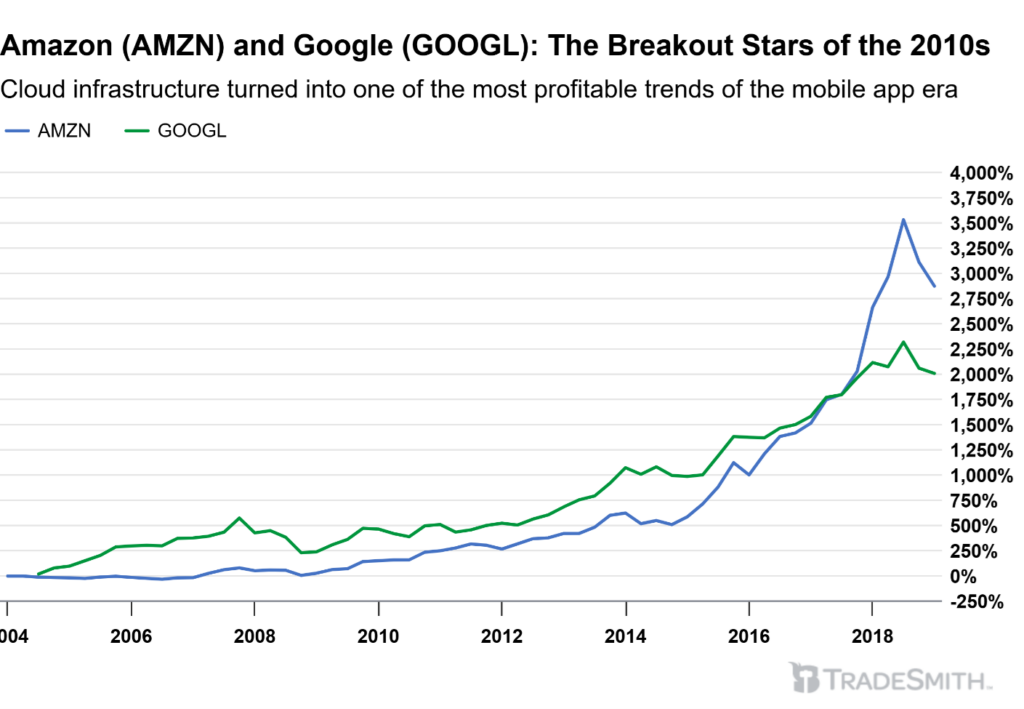

To understand how to maximize your profits in the AI revolution, it’s important to know your market history. In the 1990s, everyone chased dot-coms. But the real money was in Cisco (CSCO), building the routers.

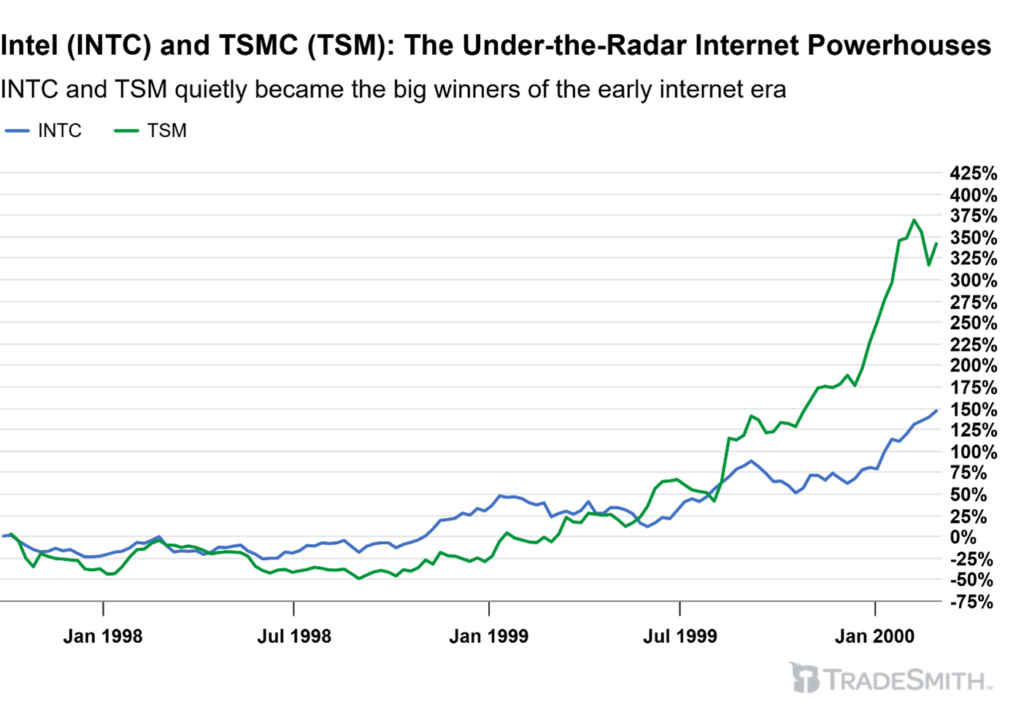

In the 2000s, investors obsessed over search engines and internet domains with catchy mascots. The winners were Intel (INTC) and TSMC (TSM), powering the chips beneath it.

In the 2010s, all eyes were on mobile apps. But the breakout returns came from cloud infrastructure.

AI is no different.

The excitement will swirl around chatbots, image generators, and digital assistants…

But the sustainable profits – the kind that define a decade – will flow to the companies supplying the compute capacity that makes all of it possible.

The Industrial Engines of the AI Economy

If Altman’s right, and AI really does need nuclear-reactor levels of compute, then we’re entering a global infrastructure buildout unlike anything since the dawn of the internet.

Power grids, data centers, and chip supply chains are being re-engineered from the ground up.

And when a technological shift collides with a physical bottleneck, it’s an opportunity to create generational wealth.

That’s why I’m watching Nvidia, AMD, and Micron so closely. They’re not the only players, but they’re three of the most critical.

Think of them as the industrial engines of the AI economy.

So when you hear about the latest chatbot, or the newest AI startup, remember Sam Altman’s words:

“If we’re limited by compute, we’ll have to choose which miracle to build.“

I know where I’d rather be looking: at the companies making those miracles possible.

Those are the kinds of opportunities our Social Heat Score is designed to spot early. The under-the-radar players the rest of the market hasn’t quite caught onto yet – but are gaining momentum behind the scenes.

We recently launched an exciting upgrade to this already powerful system, thanks to a new team-up with a man The New York Times dubbed an “icon among growth investors,” Louis Navellier.

It’s called The Ultimate Stock Strategy – and it marries our predictive consumer data with Louis’ tried-and-tested Stock Grader to identify the next Ciscos, Amazons, and Nvidias before they rocket to stratospheric heights.

The Social Heat Score has already delivered dozens of doubles over the last five years. Louis started developing his quantitative method in the 1970s and has delivered 676 double-your-money winners since then.

Together, they form the Ultimate Stock Strategy – a strategy that would’ve identified 240 such opportunities over a five-year period.

We shared all the details on Tuesday, but it’s not too late to catch the replay here.

I hope you’ll take the opportunity to see how this “ultimate” strategy could work for you – and potentially even lead to a 100% gain by Christmas time.

Until next time,

Andy Swan

Founder, LikeFolio