Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

How to Profit if Silver’s Streak Comes to a Halt

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

Even though stocks have been slumping for several weeks now due to tariff worries, the precious metals market has been absolutely on fire.

That’s especially true for gold, which shot up 31% so far this year to a record high of $3,400 per ounce this week. Gold’s poorer cousin silver has been shooting higher, too, up 13% in just the last 20 trading days.

If you participated in silver’s streak higher, you may want to cash in on some of your profits.

And for those who missed the move, you may soon get a second chance to buy the dip.

That’s because our TradeSmith seasonality indicators tell us a pull back in price may be coming soon.

Historically, silver and gold, like most assets have well defined bullish and bearish seasonal periods. And the next bearish period for silver is in May and June.

As you can see, silver is off to a fast start this year, with favorable seasonality from January through April. But the seasonal trend hits a speed bump in May and June.

In fact, since 1985, if you invested $100 in silver only during this seasonally weak period, your investment would have shrunk to less than $40! The good news is that just around the corner is the seasonally strongest month of the year for silver, July.

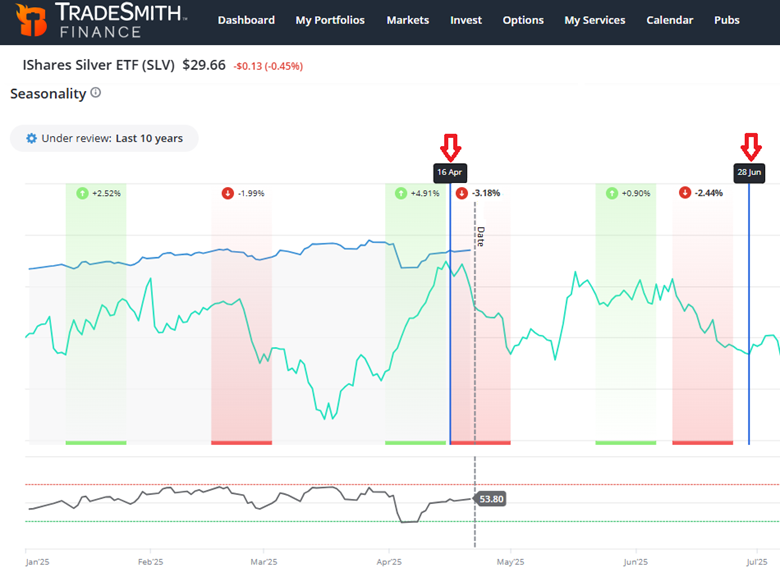

Our own TradeSmith seasonality tools confirm the upcoming seasonal weakness in silver, as you can see below.

Over the last 10 years, our seasonality indicators have shown two distinct bearish windows for silver. The first is from now through May 1 (-3.18%), and after a brief bounce higher (+0.9%), the second bearish window kicks in from June 10-June 25 (-2.44%).

Mike Burnick’s Bottom Line: Investors who caught the silver streak higher may want to consider grabbing gains and waiting out the seasonally weak spell over the next two months. More aggressive traders might consider a short position in silver, perhaps by targeting the ProShares UltraShort Silver ETF (ZSL).

Good investing,

Mike Burnick

Contributing Editor, Market Minute