Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

If You Want to Buy the Dip, Small Caps May Be Your Best Bet

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

August was another month of upside rip for stocks with the S&P 500 up 2.05% to new record highs. But the month ended, and September began with a dip.

In fact, the S&P lost all of last month’s gains in just the two trading days around Labor Day weekend.

That’s not surprising since September does have an ugly reputation for stock investors. The S&P 500 Index has been down 44% of the time during September since 1928 while posting an average loss of 1.1%.

But it’s too soon to say for certain if the Labor Day dip is just the start of a deeper pullback, or if it is just another wobble in an overbought market that is soon followed by new highs.

Only time will tell.

But if you are looking for buy-the-dip opportunities, and assuming we finally get a decent one this month, small-cap stocks may be the best place to prospect, for two reasons.

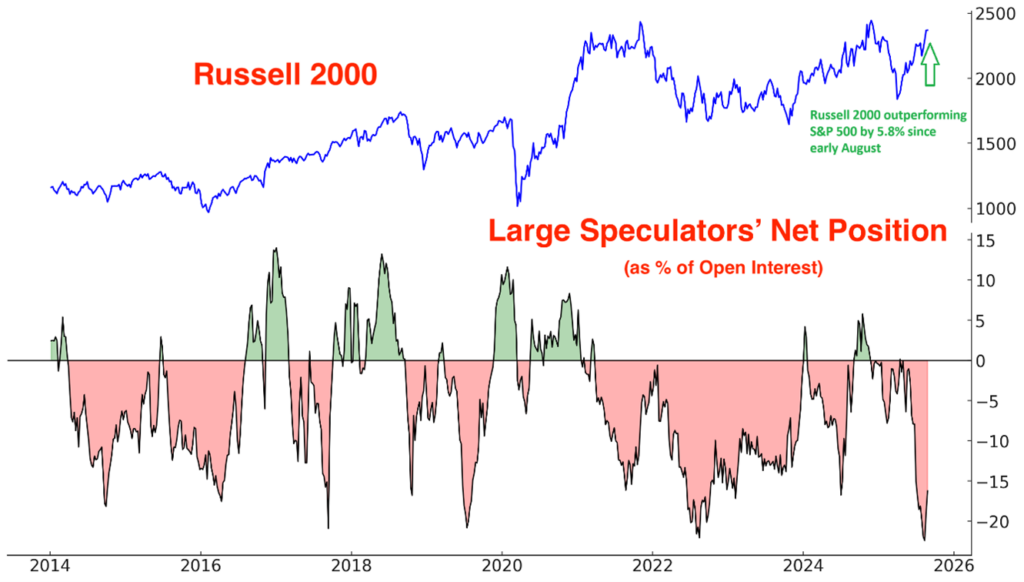

First, small caps in the Russell 2000 Index (IWM) are (finally) outperforming the big-cap S&P 500 Index (SPX), as you can see above (top panel).

Since August 11, in fact IWM (+14.6%) has outperformed SPX (+8.8%) by a pretty wide margin of nearly 6%. This outperformance appears to be driven by speculators scrambling to cover their massive, short positions in IWM, as you can see in the lower panel of the chart.

In fact, the net short position in Russell 2000 futures placed by big institutions/hedge funds was recently was one of the largest crowded short positions of the last decade. And unwinding a large short such as this can take time, driving asset prices much higher in the process.

Second, another, more fundamental factor is at work to support a small-cap stock rally: Stronger profit growth.

Profit results beat Wall Street estimates by a wide margin last quarter and investors cheered when S&P 500 earnings jumped 13.2% year over year.

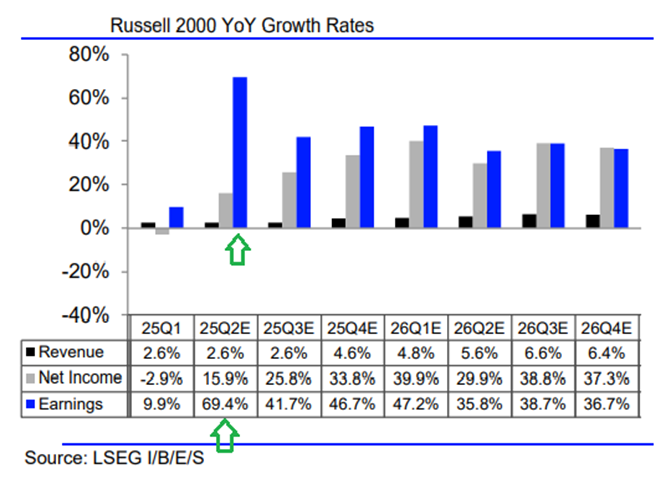

But the fact is, Russell 2000 earnings soared 69.4% (that’s not a misprint) year over year at last count, also exceeding expectations by an even larger margin, as you can see above.

Plus, take a closer look at analyst estimates for the rest of this year and for 2026… they’re penciling in 40%+ growth through the end of 2026.

Profits for the S&P 500 by comparison are forecast to grow just 10.5% this year and 13.4% next year.

Bottom line: If you’re licking your chops for a buy-the-dip opportunity now that September is here, take a closer look at buying dips in small-cap Russell 2000 stocks. You’ll be prospecting in a much more fertile field of earnings growth which could finally make small caps the best bet to catch up and surpass the S&P 500.

Good investing,

Mike Burnick

Contributing Editor, Market Minute