Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Introducing The Weight Watchers Swap Strategy

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

When it comes to making money, investors really have to watch their weight.

No, I don’t mean watching what you eat and getting plenty of exercise. I’m talking about how you weight your investment portfolio.

Wall Street is fond of creating perceived needs in investors’ minds and then building new products to fill those needs.

That’s why there are lots of funds and ETFs with interesting ways to weight the S&P 500 Index.

Some are weighted according to fundamental factors like earnings or dividends. Others are weighted by investment style, like growth vs. value.

Then there is the SPDR S&P 500 Trust ETF (SPY), which is weighted by market capitalization. And the Invesco S&P 500 Equal Weight ETF (RSP), where every stock has an equal weight.

Currently, SPY is leading. That’s because the popular Magnificent 7 stocks and a few others account for nearly 40% of SPY holdings.

But that hasn’t always been the case.

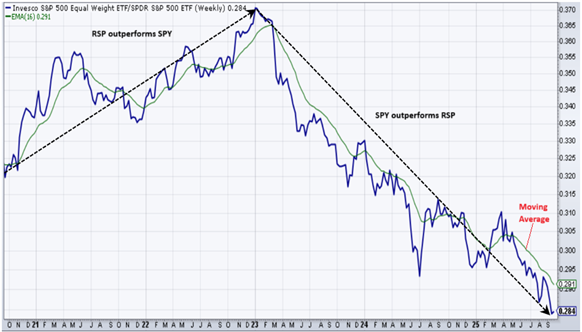

Over time RSP and SPY are practically neck and neck in overall performance as you can see above. But look closer, and you’ll see they take turns leading and lagging.

SPY has been leading since 2023, driven by the explosive growth of the Mag 7. But I believe RSP may soon take the lead in performance.

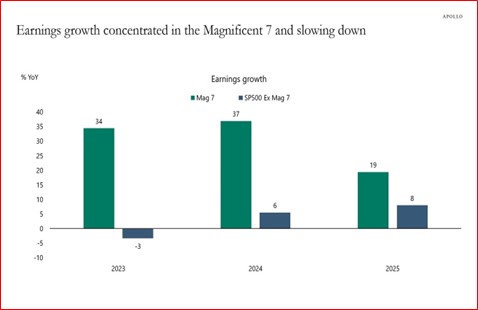

That’s because Mag7 earnings growth is slowing relative to the “average stock” in the index.

And if these heavy weight stocks that dominate SPY no longer have superior profit growth, then their sky-high valuations could suffer. Investors should look to swap into more of the “average stocks” instead.

And it turns out there is an easy way to trade the periodic swap in leadership, based on research from SentimenTrader.

This chart is simply a ratio of RSP/SPY (blue line). You can see RSP led the way from 2020 to 2023, but SPY has been in the lead since then.

The red line in the chart is a 16-week exponential moving average of the RSP/SPY ratio. And it can be used as a buy/sell signal.

- So, when the blue line is rising above the red moving average line, the equal weight S&P is leading, and you should consider buying RSP.

- And when the blue line is falling below the moving average, the market-cap weighted S&P is leading, and you should consider buying SPY.

This simple weight watchers swap strategy can pay off for you in extra profits, too. In fact, you could have outperformed a buy-and-hold strategy that invests equally in both RSP and SPY by a factor of 2-to-1 over the last 35 years.

Bottom line: Right now, the market-cap weighted SPY is still in the lead. But keep a watchful eye on its performance relative to the equal weight RSP. As the rally rolls on, I expect it will broaden to more than the Mag 7. That means the average stock should soon play catch up, leading to another change favoring RSP.

Good investing,

Mike Burnick

Contributing Editor, Market Minute