Gold stocks are facing their biggest test since the intermediate-term rally began last November.

The VanEck Vectors Gold Miners Fund (GDX) is up about 16% since we pointed out the start of an intermediate-term rally in the sector last October. But, the gold stocks have been trading poorly over the past couple of weeks. And, after last week’s 6% drop in GDX, readers have been asking, “Is the gold stock rally over?”

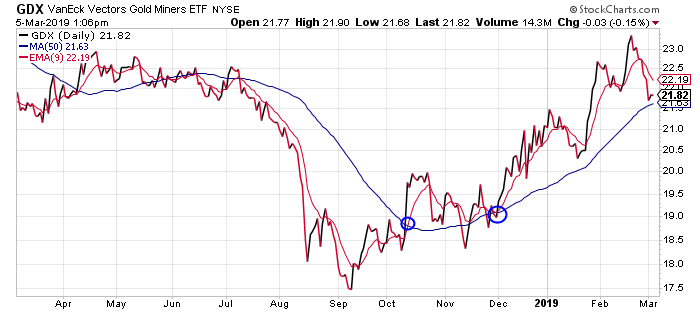

In order to answer that question, let’s take a look at the chart…

In early October, GDX rallied above its 50-day moving average (MA) (the blue line on the chart). Even more important, the 9-day exponential moving average (EMA) (the red line) crossed above the 50-day MA as well. This “bullish crossover” often marks the start of an intermediate-term rally phase.

Traders can then use any weakness that causes the 9-day EMA to come back down towards the 50-day MA as a chance to add exposure to the sector.

If the 9-day EMA bounces off of the 50-day MA, then the stock is headed even higher. On the other hand, if the 9-day EMA drops below the 50-day MA, then it creates a “bearish crossover.” In that case, traders can then exit their positions for a small loss.

We only got one really good chance to buy into the gold stock rally. That was in late November – right before gold stocks blasted higher.

We may be getting close to another chance to buy into the gold stocks.

Following last week’s decline, GDX is now testing the support of its 50-day MA. If it can just hang out at this level for another couple of days, then the 9-day EMA will drift lower and test the support of the 50-day MA as well.

And, just like the buying opportunity in late November, traders will have a lower-risk chance to buy into the gold sector. If the 9-day EMA bounces off support, then the gold sector will be poised for another rally attempt.

If the 9-day EMA falls through support – thereby creating a “bearish crossover” – then traders can exit their positions for a small loss.

Best regards and good trading,

Jeff Clark

Reader Mailbag

In today’s mailbag, a new Delta Report subscriber comments on the service…

Jeff, I just joined a few weeks ago and love the service so far. Specific trades with an explanation of why you like them, using a lot of options and then the quick (brief), timely updates sent directly to my phone is exactly what I have been looking for in a service.

– Ruel

Another subscriber wants more gold…

Dear Jeff… You don’t call… You don’t write… I’m beginning to think you don’t love me anymore.

Signed, gold and miner investor.

– Cal

And one reader gives their take on market technicals…

We cannot seem to break the 9-day EMA. This market sucks, big time!

– Ryan

How have you been trading gold? Are you betting the rally will continue… or fade?

And as always, send any other trading questions, suggestions, or stories to [email protected].