It’s time for the “catch-up” trade.

The S&P 500 has been powering to new highs constantly over the past few months. But, as plenty of financial media talking heads have pointed out, fewer and fewer stocks have been participating in the rally.

This divergence has created a rather unique situation.

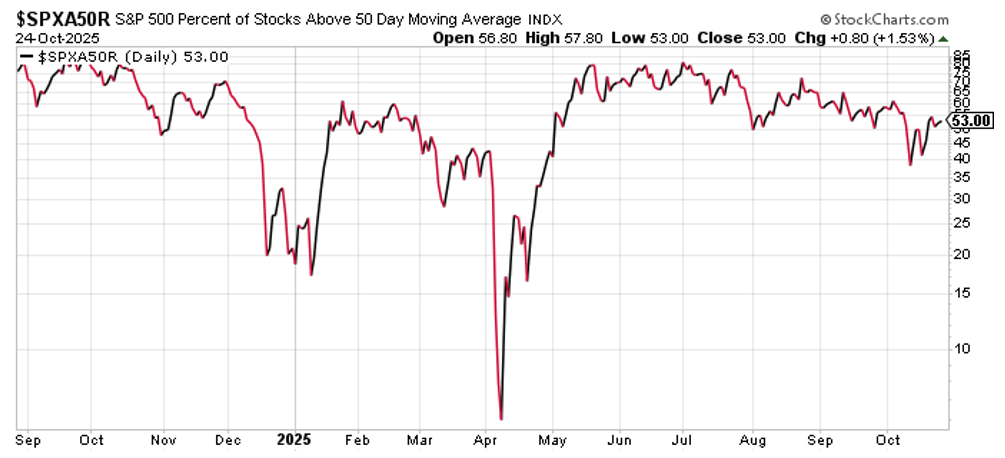

Look at this chart…

This chart shows the percentage of stocks in the S&P 500 that are trading above their 50-day moving averages. The chart peaked just above 80% in mid-May. Since then, as the S&P 500 has gained nearly 1,000 points, this chart has declined to 53%.

That means 47% of the stocks in the index are below their 50-day moving averages. They haven’t participated in the rally.

Yes… the stocks that have participated have been on fire. Momentum traders have been piling into the names. And the stocks have moved sharply higher despite overbought conditions.

Now, though, those stocks are far stretched to the upside. They’re well above all their various moving averages. And, the moving averages are far expanded away from each other. So, there’s not much energy available to fuel a continued move higher.

Those stocks are vulnerable to a pullback, or at least a period of consolidation that helps to build energy to fuel the next big move.

So, what’s a bull to do?

Like I said earlier, it’s time to play catch up.

It’s time to bet on the 47% of the S&P 500 that has not participated in the massive rally.

Many of these stocks are beaten-down value names that are trading with single-digit price/earnings ratios and fat dividends. They’ve been cast aside by impatient investors who have decided instead to chase the “hot” stocks.

As a result, the value names are in the opposite condition of the momentum stocks.

The value stocks are far stretched to the downside. They’re well below all of their various moving averages. And, the moving averages are far expanded away from each other. There’s not much energy available to fuel a continued move lower.

These stocks are establishing bottom formations. They’re setting up for a rally phase.

And, as we head into the seasonally bullish time of the year, they are set to play one heck of a game of “catch-up.”

Best regards and good trading,

Jeff Clark

Editor, Market Minute