The Nasdaq, full of the market’s leading technology stocks, has developed a split personality.

And that’s bearish for the near-term outlook.

Early this month, a relatively large number of Nasdaq stocks hit fresh 52-week highs, a positive sign.

But at the same time, there was a large jump in the number of Nasdaq stocks notching new 52-week lows, a negative.

Market analyst Norman Fosback (author of Stock Market Logic) developed a reliable indicator based on this split personality within the market.

He observed that when there was a big divergence between the number stocks at new highs and new lows simultaneously, it signaled unstable market action.

This often led to market corrections with poor returns.

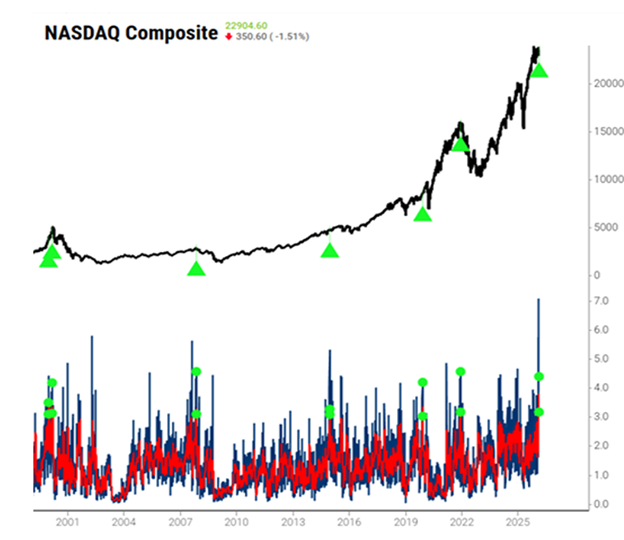

This bearish breadth signal has flashed over 30 times since the mid-1980s. And as you can see above, it has often preceded steep corrections or even bear markets for the Nasdaq.

The most recent high-low signal was on February 2. Historically, three to six months later, the Nasdaq is up just 54% of the time. Barely better than coin flip odds.

And returns for the tech-heavy Nasdaq average -0.1% during the next three- to six-month period.

Some of the worst drawdowns were prior to the 2000 and 2007 market peaks.

But more recently, this signal flashed in 2019 leading to a -20.9% drawdown four months later.

And again in 2021, triggering a -29% bear market decline six months later.

The recent personality disorder in the Nasdaq results from key semiconductor stocks like Taiwan Semiconductors (TSM) surging to new highs. But at the same time, leading software stocks like Salesforce (CRM) have been crushed, with many making new lows.

Whatever the reason, this is yet another warning sign for stock traders and investors to be wary over the next three to six months.

Good investing,

Mike Burnick

Contributing Editor, Market Minute