Economic surprises are on the rise. That’s good news for American businesses and their employees.

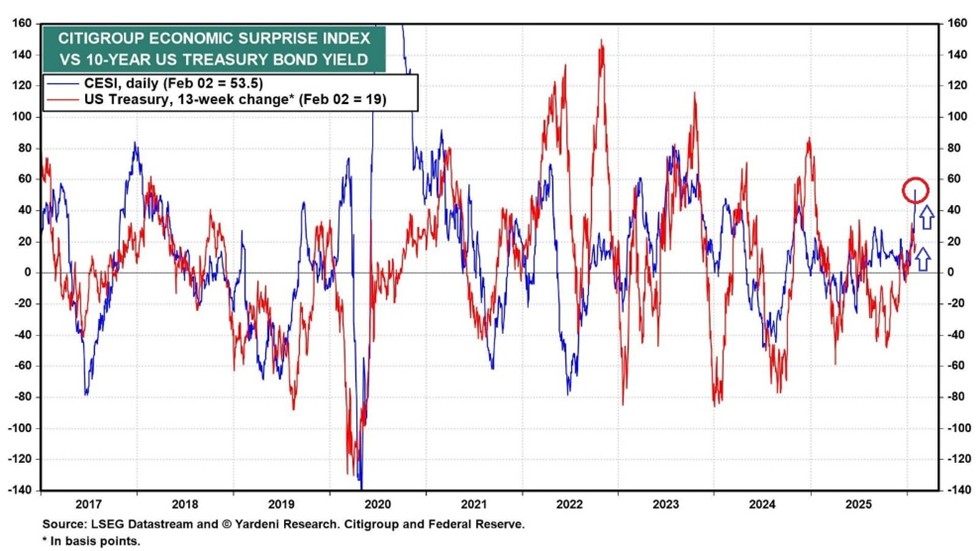

But historically, interest rates tend to follow accelerating economic growth. And faster growth in the economy typically pushes long-term interest rates higher.

That’s the potential bad news.

The Citigroup Economic Surprise Index measures the difference between positive and negative surprises in the weekly and monthly economic data.

And lately the data have been surprisingly positive, with the index moving up from near zero at the end of last year to 53.5 this week, a hot reading.

Perhaps a bit too hot.

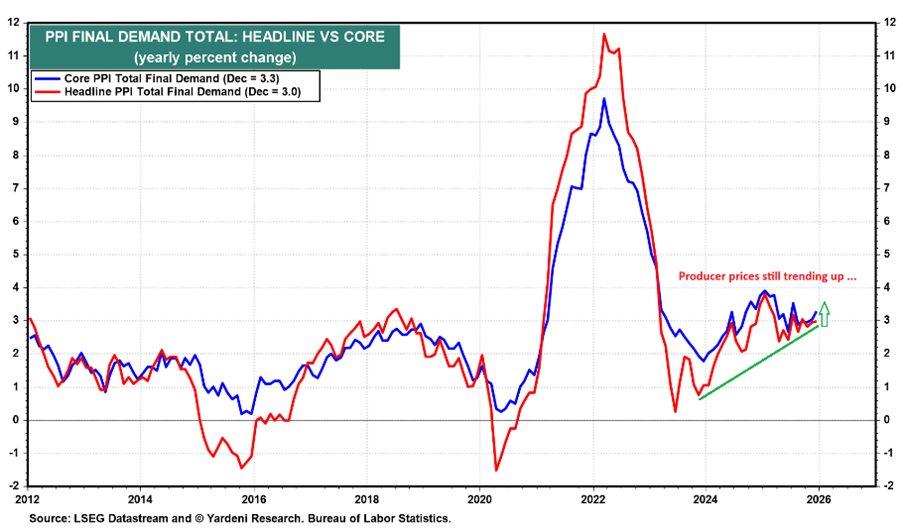

Last week’s Producer Price Index data was also hotter than expected, showing that inflation isn’t dead yet.

Last month’s core PPI surprisingly jumped to a +3.3% annual rate. And the monthly increase in prices at +0.7% was more than three times more than economists expected!

This tells me that businesses are still in the process of passing along higher tariff-related costs to American consumers.

And inflation rolls downhill starting at the producer level but soon moving down the line to show up as higher consumer prices.

Faster growth in the economy is a good thing. But when it’s accompanied by higher inflation, that typically leads to higher borrowing costs for everyone.

Bottom line: An accelerating economy, weaker dollar, and higher prices all point to higher, not lower, interest rates. Higher rates are also a drag on stock prices. And that’s especially true with market valuations as rich as they are today.

Good investing,

Mike Burnick

Contributing Editor, Market Minute