Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

Stocks Are Balancing on a Knife’s Edge

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

The S&P 500 index is closing in on its all-time high of 6147 set prior to tariff trauma in February.

But beside higher tariffs still being a potential stumbling block to higher stock prices, high valuations are another drag that could hold back market gains.

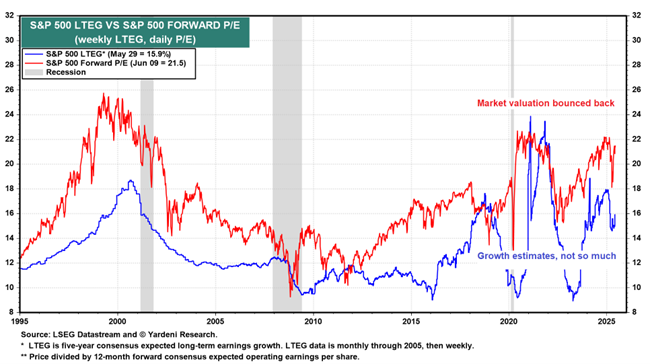

Coming into this year, stocks were already richly priced with the S&P 500 trading at a forward price-earnings (P/E) ratio of 22x, compared to an average P/E ratio of about 16x for the index over the past 40 years.

That’s most likely the reason why the tariff-induced selloff in stocks was so severe. There was little or no margin for error with valuations stretched to the upside.

Fast forward to now, and the S&P 500 forward P/E ratio at 21.7x has bounced back to almost where it was pre-tariffs, as you can see above (red line).

But the problem is, growth estimates for S&P 500 earnings have not bounced back along with the sky-high P/E ratio. And that makes market valuation a problem again.

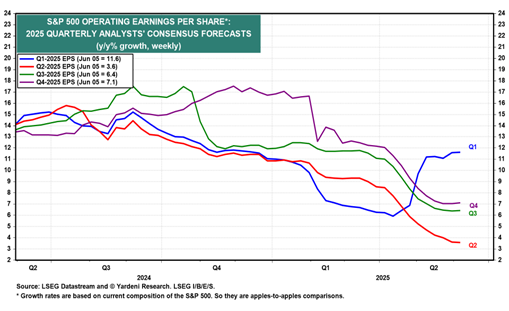

In fact, Wall Street analysts have been steadily cutting their S&P 500 profit estimates for both the rest of this year and for 2026.

While first-quarter results are strong with earnings 6% above expectations, that was before tariff costs really kicked in for companies. Wall Street has been sharply cutting their S&P 500 earnings-per-share estimates for Q2 through Q4 (see chart above), as well as for 2026.

Mike Burnick’s Bottom Line: So far, profit estimates have only been cut by about 3 to 4%, which doesn’t sound like much. But with market valuations just about priced for perfection today, anything less than perfect profit results could quickly spoil the party for stocks.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

P.S. While less-than-perfect results are sure to send markets spiraling… Jeff Clark is waiting in the wings to take advantage of the incredible money-making opportunities that volatile, panicky, crashing markets offer.

Because those conditions are great time to make money. Just ask Jeff – trading them is how he has made most of his wealth…

By trading the 2008 financial crisis… trading the 2020 covid crash… trading crypto market panics… trading the 2000 and 2022 tech wrecks… trading the April tariff flash crash…

These were all big opportunities that Jeff and his subscribers capitalized on.

Because in his world, bad news is good news. You can access his chaos strategy right here to find out how you can make truly lifechanging wealth in the most difficult market conditions for most investors.