The bears got one day to celebrate.

After rallying for several days, the stock market turned lower on Wednesday morning. The S&P 500 fell hard prior to the Federal Open Market Committee (FOMC) announcement on interest rates. Then it rallied in a kneejerk response to the Fed’s “dovish” statement. But, the intraday bounce couldn’t hold. Stocks turned lower in the final hour and the S&P 500 closed down nine points.

Stock futures traded lower on Thursday morning as well. Prior to the market opening, S&P 500 futures were down 12 points. It looks as though we’d get back-to-back daily declines – a rarity in the market this year.

Finally, it looked like all of the technical warning signs that have been screaming “CAUTION” for the past month would finally be proven correct. If the market was going to start a several-day-long decline phase, then now was the perfect time to do so.

Five minutes into the trading session on Thursday morning – just as the S&P 500 was testing important support near 2815 – buyers stepped up and kicked the bears in the teeth once again.

The S&P rallied to a new recovery high yesterday. The index is now at its highest level since early October.

It’s hard to be bearish. Heck, it’s hard to just be cautious as the market keeps popping higher. The pressure to go “all-in” is so intense.

But, we’ve seen so many times how chasing the stock market higher into overbought conditions is usually a bad idea. Broad stock market declines have not been repealed or outlawed. They tend to show up just about the same time as investor optimism reaches an extreme level.

And, we may have hit that level yesterday.

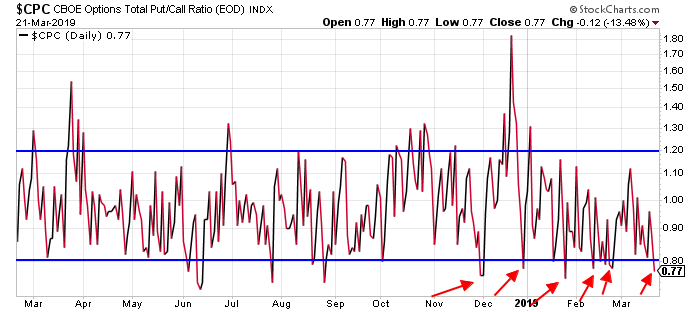

Here’s an updated look at the CBOE Put/Call ratio (CPC) – which continues to be one of the best, short-term market timing tools over the past year…

The CPC is a short-term, contrary indicator. It compares the action in call options to the action in put options. A reading above 1.20 shows extreme bearishness among speculators and can indicate a good time to buy stocks for the short term. A reading below 0.80 shows extreme bullishness and could indicate a good time to sell.

The CPC dipped below 0.80 in early December – right before the S&P 500 dropped 450 points in three weeks. The ratio dipped below 0.80 again in late December – after a blistering week-long rally that flipped investor sentiment from extremely bearish to extremely bullish.

The S&P 500 dropped a quick 50 points in just two days after that.

We looked at this indicator in mid-February, when the CPC dropped to 0.78. The S&P fell only 25 points following that signal. That’s not much of a move (just about 1% or so). But, for traders looking to make quick gains, a 1% move in two days is a pretty good payout.

The CPC then dipped below 0.80 again at the end of February, just before the S&P sold off 60 points in just a few trading days.

Yesterday, the CPC closed at 0.77 again. At a minimum, the market is due for a pause right here. And the “worst case” could be a whole lot more damaging.

Like I said earlier, it’s hard to be bearish or even just cautious right here. But, for the very short term, it’s probably dangerous to be too bullish.

Best regards and good trading,

Jeff Clark

P.S. As you folks already know, some days, there simply isn’t much action in the market. Other days, the market goes nuts. And right now, it’s hard to be bearish or even just cautious.

That’s why I play a game most guys on Wall Street don’t. My trading philosophy in the Delta Report is more about reducing risk than it is about always swinging for the fences, even if that looks tempting.

But reducing risk doesn’t take big profits out of the equation…

To learn how, read on here.

Reader Mailbag

How are you trading this up-and-down market? Are you bullish or bearish?

And as always, you can send any other trading questions, stories, or suggestions to [email protected].