This could be a rough earnings season for the semiconductor stocks.

That’s an unpopular opinion, for sure. Most analysts expect record results from companies like NVDIA, Broadcom, Micron Technologies, Advanced Micro Devices, and the rest of the chip names. Indeed, nearly the entire semiconductor sector has been racing higher in anticipation of stellar earnings reports.

And, that’s the problem.

The stocks have rallied so far so fast the share prices already discount outstanding earnings results. That sets the stage for a “sell on the news” event once the earnings are reported.

Good news is already priced into the stocks. Folks bought shares in anticipation of strong results. Once they get the results they may decide it’s time to hit the sell button – even if the news is good.

And, if the news is bad then look out below.

It also doesn’t help that relative to the S&P 500, the semiconductor sector is trading at its highest level – ever.

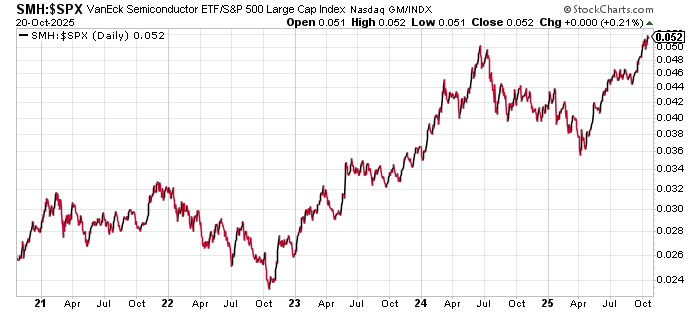

Look at this ratio chart comparing the performance of the semiconductor sector ETF (SMH) to the S&P 500…

When this chart is moving higher, semiconductor stocks are outperforming the broad stock market. When the chart is falling, the chips are underperforming.

SMH has outpaced the stock market since everything bottomed in early-April. While the S&P has rallied 36%, SMH is up 92%. This marks the strongest level of outperformance ever.

The last time we saw something similar was in late-June 2024, just prior to the second quarter earnings season. SMH dropped more than 20% over the next two months. NVDIA fell 26%. Advanced Micro Devices fell 28%. And, Micron got hit with a 40% decline.

Of course, that doesn’t mean the semiconductor sector has to fall this time around. Nothing is guaranteed in the stock market. It is possible the upcoming earnings results will be so much better than even the loftiest expectations, and the stocks will rally to even higher levels.

Though, that seems unlikely.

Everybody who wants to own the semiconductor stocks in anticipation of a record-breaking earnings season has already bought the stocks. It seems far more likely that once the earnings are reported, some of these folks will be looking to get out.

That’s when things can get dicey.

Best regards and good trading,

Jeff Clark

Editor, Market Minute