If you’re looking to buy gold stocks, you’ll likely have a better chance to do so a few weeks from now. The gold sector is overbought and on the verge of a sell signal.

The bullish percent index for the gold sector (BPGDM) closed Friday at 100. That means 100% of the gold stocks in the index are trading with a bullish technical formation.

It doesn’t get any better than that. And, if it can’t get better, then it can only get worse. Once the BPGDM turns lower from here, it will generate a gold stock sell signal.

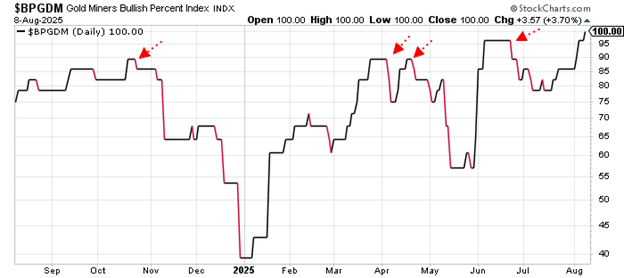

Here’s the chart…

The BPGDM measures the percentage of gold stocks that are trading in a bullish technical formation. It’s basically a gauge of overbought and oversold conditions.

Since it’s measured as a percentage, a bullish percent index can only reach as high as 100% or fall as low as zero.

Typically, the gold sector is extremely overbought when its bullish percent index rallies above 80%. It’s extremely oversold when it drops below 30%.

Sell signals are generated when the index rallies above 80% and then reverses. The red arrows on the chart show the various sell signals over the past year.

Here’s how the gold stocks behaved following those signals…

The Gold Bugs Index (HUI) fell immediately on all of the BPGDM sell signals – with three of the four signals triggering declines of 10% or more.

The most recent sell signal in June, though, didn’t do much damage. HUI fell only about 4% from its high before turning around and surging to new all-time highs.

Now though, with the BPGDM trading at 100, and with the price of gold looking vulnerable to a pullback if/when the dollar rallies, the next sell signal could be more significant.

I’m not suggesting traders should sell all of their gold stocks here. But, with HUI already up 60% for the year, and with the BPGDM on the verge of a sell signal, maybe now is not the best time to put new money to work in the gold sector.

Traders should have a chance to buy gold stocks at lower prices a few weeks from now.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.