Managing Editor’s Note: Jeff Clark has teamed up with TradeSmith – the premier provider of fintech software, helping investors thrive in bull and bear markets for 20 years.

It’s also a financial newsletter behemoth featuring in-depth market analysis from some of the best and brightest names in the industry.

At the heart of this partnership, both TradeSmith and Jeff are dedicated to helping everyday investors navigate highly volatile periods, like we’re in now, so you can profit on both the ups and downs in markets, while exposing yourself to the least amount of risk.

To reflect this partnership, Jeff Clark’s Market Minute is becoming TradeSmith’s Market Minute.

Don’t worry, you’ll still get the same, quick-hit market analysis from Jeff three days a week… we’ll just be adding other expert analysts into our rotation… like Mike Burnick in our new Thursday slot.

As always, any questions or comments – good or bad – let us know at [email protected].

The Junk Bond Market Tells Us We’re Not Crashing Yet

BY JEFF CLARK, EDITOR, MARKET MINUTE

The junk bond market is telling us it’s too early to bet on a crashing stock market.

There’s nothing wrong with being cautious. There’s nothing wrong with trimming some positions and raising some cash as the stock market puts on an oversold bounce.

But, betting aggressively on the downside right now is probably a mistake.

Yes, economic conditions appear to be slowing. Yes, there’s a bunch of political chaos that is adding uncertainty to the financial markets. And yes, the stock market is going to be volatile.

But, until the high-yield bond market breaks down, the stock market is not going to crash.

High-yield bonds are a leading indicator for the stock market. When “junk” bonds are rallying, it’s a risk-on environment. That tends to be bullish for stock prices.

When high-yield bonds are falling, investors are in risk-off mode. That’s bearish.

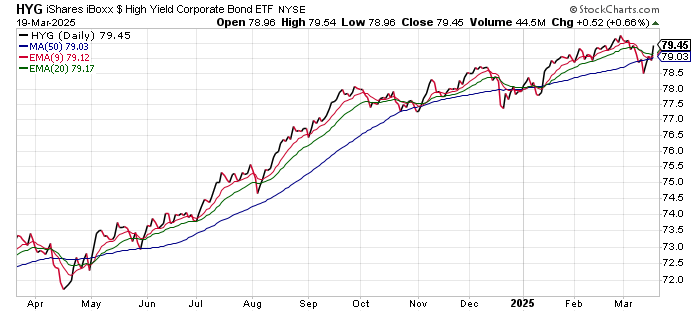

So, it’s useful to note that while the S&P 500 recently traded down 10% from its high – putting it in “correction” mode – the iShares iBoxx High Yield Corporate Bond ETF (HYG) has recovered to within spitting distance of its all-time high.

Take a look at this chart…

There isn’t anything bearish on this chart.

HYG is trading above all of its various moving average lines. And, the moving averages are in a bullish configuration – with the 9- and 20-day EMAs above the 50-day MA.

If the broad stock market was setting up for a crash, then the chart of HYG would be leading the way lower. But, that’s not happening… yet.

The action in the junk bond sector suggests the recent decline in the broad stock market is nothing more than a short-term dip.

Of course, that could change. If HYG starts to break down and lose the support of its moving average lines, then we’ll be setting up for a more significant decline in the stock market.

That will be the time for traders to add short exposure in anticipation of a crash.

I suspect it will happen at some point this year… just not right now.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.