Managing Editor’s Note: Before we get to this morning’s edition of Market Minute, we’ve got an exciting announcement…

Jeff has teamed up with TradeSmith – the premier provider of fintech software, helping investors thrive in bull and bear markets for 20 years.

It’s also a financial newsletter behemoth featuring in-depth market analysis from some of the best and brightest names in the industry.

At the heart of this partnership is that, both TradeSmith and Jeff are dedicated to helping everyday investors navigate highly volatile periods, like we’re in now, so you can profit on both the ups and downs in markets, while exposing yourself to the least amount of risk.

To reflect this partnership, Jeff Clark’s Market Minute will shortly become TradeSmith’s Market Minute.

Don’t worry, you’ll still hear the same, quick-hit market analysis from Jeff three days a week… we’ll just be adding other expert analysts into our rotation… So be on the lookout for that.

As always, any questions or comments – good or bad – let us know at [email protected].

The Market Finally Looks Ready to Bounce

BY JEFF CLARK, EDITOR, MARKET MINUTE

Finally… after a brutal, three-week decline in the S&P 500, the stock market looks ready to bounce.

It’s about time. We’ve been anticipating a bounce for the past several sessions. But it took five Volatility Index (VIX) buy signals and a “crash alert” comment from my wife to finally kick the bounce into gear.

The S&P 500 traded as low as 5504 last Thursday. That led to the biggest gain of the year on Friday. And, the technical conditions are oversold enough to fuel the market higher through the end of the month.

Make no mistake, though, there was a lot of technical damage done to the market during its recent correction. The bulls have a lot of work to do in order to repair the damage. So, the nature and extent of this oversold bounce will tell us a lot about the direction of the stock market for the rest of 2025.

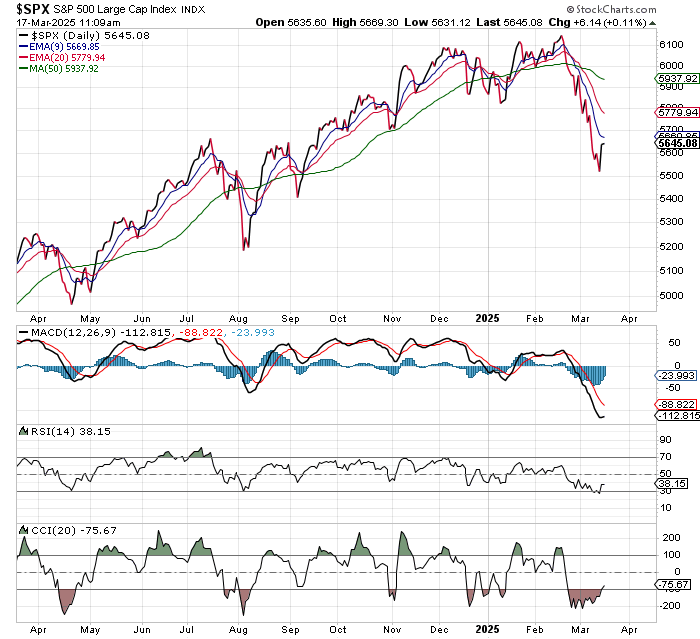

Take a look at this chart of the S&P 500…

You can see how steep the decline has been over the past three weeks. You can also see the momentum indicators at the bottom of the chart are more oversold than at any other time since last August.

The bulls’ hope is that this current bounce looks a lot like the oversold bounce out of the decline from last August. Back then, it took only a couple of weeks to recover the lost ground. The S&P hit a new all-time high a couple months later.

But, that’s going to take a Herculean effort.

The S&P needs to climb back above all of its various moving average lines in order to confirm a bullish trend. Those MAs will offer resistance on any rally attempt. And, since the MAs are spread far apart from each other, and they’re downward sloping, the market is going to use up a lot of energy to rally above each line.

It could happen, of course. The market is in a seasonally bullish period between now and the end of the month. We have a cluster of VIX buy signals. And investor sentiment (a contrary indicator) is bearish enough to provide a lot of fuel for a strong bounce.

But, that bounce has to push the S&P 500 back above its 50-day MA (5935-ish) before we can be confident the bull is still kicking. Otherwise, the S&P will form a lower high on this move, and then turn lower.

If that happens, traders should expect lower stock prices as we head into summer and fall.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.