The recent stock market rally has done what every bear market rally is supposed to do…

It punished bearish traders who held short positions too long, and it coaxed reluctant bulls back into the market for fear of missing out – just in time for the bear to take another swipe.

It looks like that “swipe” could start any day.

We’ve already published several articles this week about how the stock market is setting up for a decline. And, at the risk of provoking even more nasty feedback from bullish readers, please allow me to throw another log on the bearish fire.

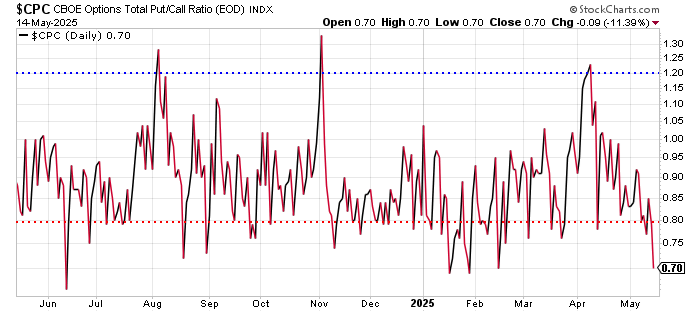

Look at this chart of the CBOE Put/Call ratio (CPC)…

The CBOE Put/Call (CPC) ratio measures investor sentiment (a contrary indicator) by taking the total volume of put options traded on a given day and dividing it by the total number of call options.

Whenever the ratio spikes above 1.20, it indicates traders are rushing to buy put options and make bearish bets – which is bullish from a contrarian standpoint. When the ratio drops below 0.80, traders are aggressively buying call options and betting on an upside move – which is ultimately bearish.

For example, last month – after the S&P 500 had fallen 20%, and it looked like the world was ending – the CPC hit 1.22. That coincided with a short-term bottom in the stock market.

In mid-February, as the S&P was posting an all-time high above 6100, the CPC hit 0.70. The S&P 500 dropped 1100 points over the next six weeks.

So, it’s probably worth noting the CPC closed at 0.70 on Wednesday.

In other words, despite the S&P 500 trading 1000 points above last month’s low, and despite all of the overbought conditions we’ve shared with you in Market Minute this week, traders were still jumping over themselves to buy call options.

It’s rare for the stock market to sustain any sort of rally when the CPC is this low. So, while investors might be breathing a sigh of relief that the market has rallied back from the tariff trade war decline, traders ought to be looking over their shoulders right here.

The CPC indicator is suggesting there’s at least a short-term decline in front of us – if not something even more severe.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

P.S. This market environment is the perfect playing field for my newly released Bill Payer strategy… Because even when the markets are chaotic and volatile, you can use what I believe is the single best income-producing strategy to make upward of $400… in just one week.

And this isn’t a cherry-picked result. I’ll show you how to do it over and over again with one straightforward investment vehicle.

To check out how I put this strategy to the test by paying for an entire day’s worth of purchases around Miami, go right here.

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.