Traders should watch the action in the junk bond market over the next few days.

The action in junk bonds tends to lead the action in stocks. So, it’s worthwhile to note that as the S&P 500 rallied to a new all-time high this week, junk bonds have been slowly drifting lower.

It’s not a dramatic decline, yet. So, maybe there’s nothing to worry about. Maybe junk bonds are just crying “wolf” on this move. But, the last time we noticed a bearish pattern developing in HYG – the High Yield Corporate Bond ETF – the S&P 500 dropped 50 points in less than a week.

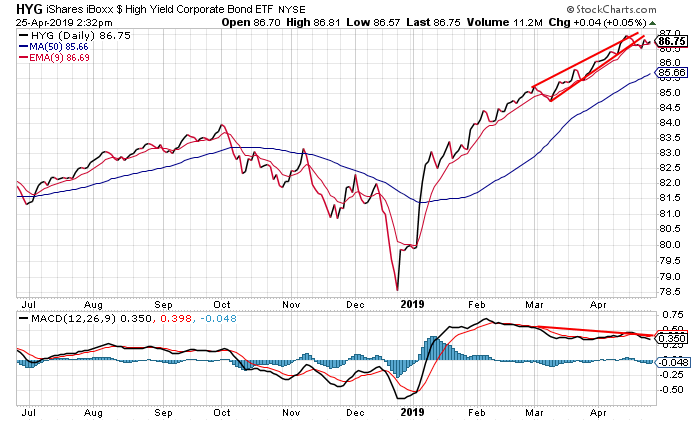

Here’s an updated look at HYG…

The first thing you’ll notice about this chart is that as HYG has been moving higher over the past two months, the MACD momentum indicator has been moving lower. This sort of negative divergence is often an early warning sign of a potential reversal.

Now, over the past week, HYG appears to be breaking down from a bearish rising wedge pattern. If this decline accelerates, then HYG could pull back towards its 50-day moving average (MA) line at about $85.66.

Now, let’s take a look at a chart of the S&P 500…

This chart shows a similar bearish rising wedge pattern with negative divergence on the MACD momentum indicator. A breakdown from the wedge could lead to a test of the 50-day MA at about 2832. That’s a drop of nearly 100 points in the S&P 500.

Longtime readers will recall that HYG tends to lead the broad stock market by anywhere from a few days to a couple of weeks. So, this week’s decline in HYG is notable. If HYG continues to press lower next week, then the odds favor the S&P 500 breaking down from its wedge pattern as well.

Best regards and good trading,

Jeff Clark

Reader Mailbag

Which sectors do you pay most attention to? Have you been following the action in HYG?

And as always, you can send any other trading questions, suggestions, or stories to [email protected].