It has been two weeks since we last looked at the S&P 500.

Back then, we noted the primary trend of the market had changed from bullish to bearish. But, conditions were so oversold we were likely to see a “snap-back” rally throughout the month of January.

So far, so good.

The S&P 500 is up almost 5% over the past two weeks. Most technical conditions are not even close to being overbought yet. So, there’s still plenty of energy available to fuel a move higher towards the 2625 target (or higher) we pointed to two weeks ago.

There are two ways to get there…

Stocks could just keep moving straight up from here. Buyers have been willing to step up on every minor decline over the past several sessions. That tells us folks are eager to put money to work. And with a high level of buying interest, we could see the upside target get hit well before the end of the month.

Or, we could get a pullback first – for at least a couple of days – followed by a rally into the end of the month.

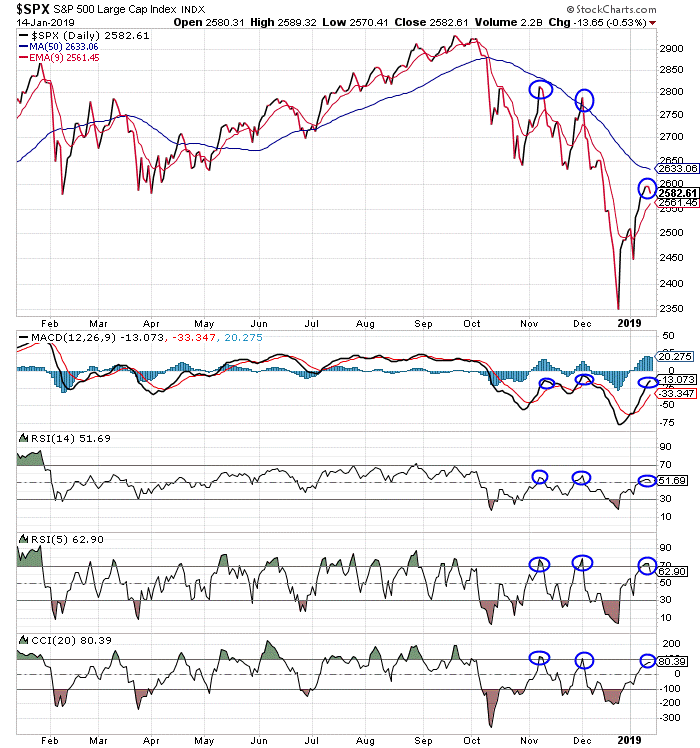

Take a look at this chart…

The rally over the past two weeks has been pretty much straight up. The index gained nearly 150 points before taking a break on Monday. As a result, all of the technical indicators have rallied back up to the levels at which they peaked during market bounces in November and December.

If the market continues to play out a similar script, then it’s reasonable to expect at least some modest weakness from here. Maybe the S&P comes back down to the 2560 level and tests its 9-day exponential moving average (EMA) as support. Or maybe we get a stronger decline, to about 2525, just to shake up some of the recently converted bulls.

Either way, a brief decline here should give traders a chance to add some long exposure in anticipation of a rally into the end of the month.

My point is simple… whether stocks move straight up from here or we have to suffer a brief decline first, our upside target of 2625 still looks like a good target. And, if the buying pressure really kicks into gear, a move up towards 2670 or so is possible.

Remember, though, what I wrote about earlier this month… traders should look to use this rally as a chance to reduce long exposure and possibly add some short exposure.

Best regards and good trading,

Jeff Clark

Reader Mailbag

In today’s mailbag, a couple of subscribers talk about Jeff’s Mastermind…

This is turning out to be a great program – as usual from Mr. Clark… All the best, thanks.

– Diarmuid

Love the quizzes idea! Great way to reinforce the lessons. Wouldn’t mind a few more questions!

– Jack

What do you think the stock market’s next move will be? And how are you preparing for it?

And as always, send any other trading questions, stories, or suggestions to [email protected].