There’s a rally brewing in the Treasury bond market.

That may seem crazy because Treasury bonds are having their worst year ever. The iShares 20+ Year Treasury Bond ETF (TLT) is down 26% so far in 2022.

And with the Fed committed to raising interest rates at its meeting next week, lots of folks are betting that the Treasury bond market will fall even more.

But I’m not so sure…

The financial markets tend to discount future events.

Meaning, rather than selling off when the Fed raises interest rates next week – Treasury bonds have been selling off for the past few weeks in anticipation of the event.

So, it seems that once the event is out of the way, T-bonds are more likely to rally. After all, it has happened before.

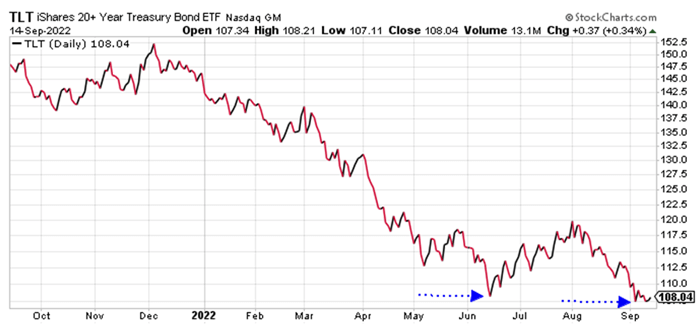

Take a look at this chart of TLT…

The last time TLT traded at its current price (near $108) was back in June before the scheduled Federal Open Market Committee (FOMC) meeting on June 14-15.

TLT had fallen from $118 in mid-May to $108 in mid-June in anticipation of the Fed raising interest rates at its June meeting.

However, once the announcement was out of the way, TLT started to rally. It gained 11% over the next six weeks. A similar move this time around could have TLT trading near $120 per share by Halloween.

|

Free Trading Resources Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Yes, it seems crazy to think the Treasury bond market could rally while the Fed is rapidly raising interest rates. But the financial markets discount future events.

So, the 10% decline in TLT over the past month has likely already discounted the Fed raising its Fed Funds target rate by 0.75% next Wednesday.

Folks have been selling Treasury bonds in anticipation of that news. Once that news is out of the way, the selling will be exhausted.

And that’ll set the stage for a countertrend rally in the Treasury bond market.

Best regards and good trading,

|

Jeff Clark

Reader Mailbag

In today’s mailbag, a Market Minute reader shares his theory on silver prices…

The criminals in the government have been killing silver for 40 years. The reason: It’s owned by little people – the masses. One day, the masses will rule.

Driving silver into the ground is a cover for the bankrupt U.S. dollar. Most folks are afraid of it because “It hasn’t gone anywhere.”

JPMorgan Chase has been controlling the price of silver for almost 15 years and has pocketed trillions. They were given 150 million ounces of real silver when Lehman Brothers got taken down in 2008.

They can short silver without even putting up any money. They simply guarantee they’re good for it with their illegal trillion-dollar money heap. (Three of the very wealthy participants in the silver supervisory Commodities Trading Commission are now facing trial for bilking the masses out of trillions of dollars.)

The masses are not going to be happy. They’ll use up all the world’s silver and it’s needed for the green stupidity. Silver today should be at least $125 an ounce. In the days ahead, silver will top $18,000 an ounce when it’s no longer available due to the masses. The masses will rule.

– William S.

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].