Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

This Indicator Has a 100% Success Rate so Far…

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

The drumbeat of doom in both the financial and popular press grew very loud since “liberation day.”

Market sentiment got so bearish that it was actually bullish.

By almost any measure you choose, stocks were extremely oversold. All that was needed next was for buyers to step up to the plate. And last week, buyers showed up in a very big way.

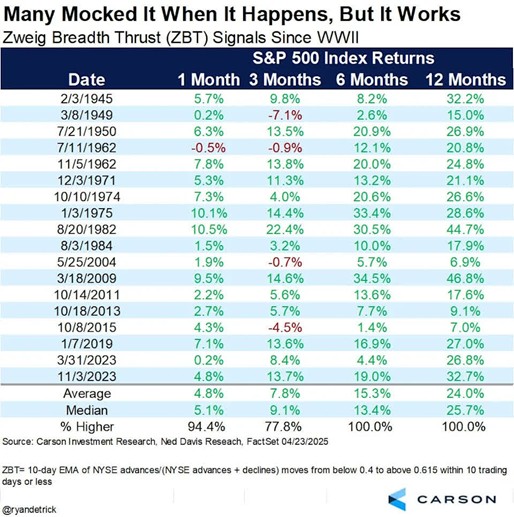

In fact, stocks triggered a rare indicator called the “Zweig breadth thrust” last week. It’s ultra-bullish for the stock market’s long run prospects.

It was named for the late great Wall Street legend Marty Zweig, who came up with this indicator.

Not to get too technical here, but a breadth thrust happens when the 10-day average of advancing stocks divided by advancing + declining stocks swings from deeply oversold (below 40%) to overbought (above 60%) in 10 trading days or less.

In practical terms, it means buyers suddenly and completely overwhelm sellers. And it’s a classic signal of a potential bottom in stocks when sentiment improves so rapidly and dramatically, as you can see above.

Since 1945, 18 breadth thrusts have triggered for the S&P 500. Last week was number 19.

And stocks have been higher six and 12 months later every single time, with the S&P 500 posting median gains of +25.7% one year later.

Mike Burnick’s Bottom Line: Granted, stocks are now overbought after this strong thrust higher. And let’s face it, tariff trouble continues to lurk in the background. So, a near-term market pullback is a distinct possibility. But if so, that should be a great buying opportunity for the long run. Because last week’s bullish breadth thrust means stocks could be substantially higher by this time next year.

Good investing,

Mike Burnick

Contributing Editor, Market Minute