The single best short-term market timing indicator just flashed a “sell” signal.

We look for extreme conditions in the CBOE Put/Call ratio (CPC) to give us an idea of where the broad stock market might be headed over the next few days.

And, so far this year, the CPC has been 100% accurate as a contrary indicator.

The CPC is a short-term, contrary indicator. It compares the action in call options to the action in put options. A reading above 1.20 shows extreme bearishness among speculators and can indicate a good time to buy stocks for the short term. A reading below 0.80 shows extreme bullishness and could indicate a good time to sell.

The CPC closed at 0.78 last Thursday. Traders were buying far more call options than put options. And, from a contrarian perspective, that should lead to weakness in stocks in the days ahead.

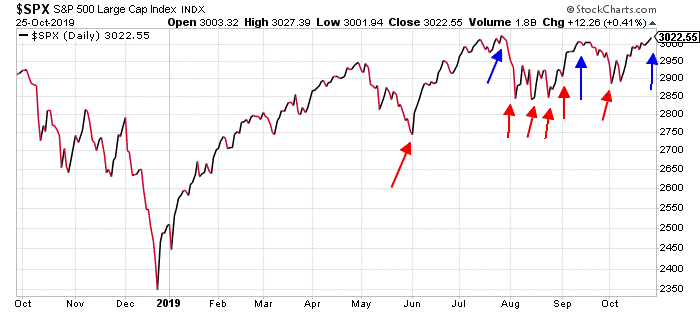

Take a look at this chart of the CPC…

The blue arrows on the chart point to times over the past few months when the CPC dipped below 0.80 and generated a sell signal. The red arrows point to when the indicator jumped above 1.20 and triggered a buy signal.

Here’s how those signals played out on the S&P 500…

In every single case, buying the S&P 500 when the CPC popped above 1.20 and shorting S&P 500 when the CPC dipped below 0.80 was a profitable trade.

I don’t know of any other indicator that has been so remarkably accurate this year. And, I don’t know if this indicator will continue its winning streak. But, this new CPC sell signal is enough to keep me cautious going into this week.

This isn’t a long-term signal, of course. So, we’re not using it to figure out where the stock market will be several weeks or several months from now. Trader sentiment is far too fickle to provide long-term insight.

We’re just looking out several days. And, based on the “sell” signal that triggered at the close of trading last Thursday, the setup looks bearish for this week.

Best regards and good trading,

Jeff Clark

P.S. Lately, another important indicator has been on my radar.

It only works on a specific corner of the market, but so far it’s yielded excellent results – for me and subscribers.

I’m offering access to this new research only for a couple more days. So, if you’re interested, find out more here.

Reader Mailbag

Today, new Breakout Alert readers share their thoughts…

I paid for lifetime subscription last night and bought all 3 of your recommendations this morning at 10 a.m. I did not even read the report. Just bought all the stocks immediately.

It had already paid for my lifetime subscription within 2 hours.

– Brad

What a great start to Breakout Alert. Clean recommendations with good back-up for both possible gains and cautions about possible losses. Now we’ll see how the charts have worked for identifying these as winners! Always fun to read your posts.

– John

Thanks for the offer and webinar.

Enjoyed the webinar and while I watched, I tuned into some of the stocks… well, all of the stocks you mentioned to see how they looked. Your examples were recent and I could examine how my trading analysis platform would have interpreted the moves you describe.

The moves are clearly there and easily picked up by my platform so it is something I will have to scan for and try trading. Maybe even try some of my ideas about creating that line you added to the charts.

– Milton

And a few Delta Report subscribers respond to a special update…

“What Are We Paying You For?” was a great post. Thanks for the right approach to investing! We pay you for profitable trading advice. There are plenty of advisors out there who just want trades. Glad you’re not one of them!

– Rick

I’m sorry you get such negative feedback when you don’t gin up trades every day. I can only speak for myself, but I appreciate it when you validate the fact I can’t find anything but a few in-and-out trades… like now. I think it was Howard Marks who said, “knowing what NOT to do is the most important thing”.

Ok, he has a lot of “most important things”… but I learn when you don’t do anything. Gutsy call on the October crash, but since I know you are often early ;-), I’m betting on November maybe when SMH finally breaks down. Thanks for the ongoing education… worth every penny.

– Mark

Hey Jeff, I truly find it a bit absurd that you are expected to produce a recommendation when the market doesn’t really offer up much. While I realize you’re under pressure to offer up something each week, I value you NOT doing so when the world isn’t cooperating.

As a side, I lost A LOT of money (for me) with you when you were doing the gold trading deal at Stansberry back in 2011, but I’m more experienced and wiser (I hope) this time around and am more patient with the things I get involved in. I’m pleased with your work thus far in my first year here. I’m a relatively small investor, so in the end I need to pay for the subscription plus make a return that makes the experience worthwhile. Thanks for your efforts. I’m doing ok with you this time around.

– Kermit

Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].