Gold was one of the best-performing assets last year with the yellow metal up over 60% in 2025, hitting 50 new all-time highs along the way.

But it was gold’s poorer cousin, silver, that really stole the show in 2025 with an even bigger winning streak, soaring an incredible 145% in 2025.

Both precious metals have put the stock market’s returns to shame over the past year. But for silver there was more at work than only its store-of-value attributes. The Chinese government slapped new export restrictions on silver starting New Year’s Day 2026.

And since China controls an estimated 60-70% of the refined silver supply worldwide, this partial export embargo creates a possible supply-demand imbalance. This most likely accounted for some of the most recent parabolic upside streak in silver.

But headlines like this can often mark at least a near-term top in commodities. Especially those, like silver, that have enjoyed a breathless upside move already.

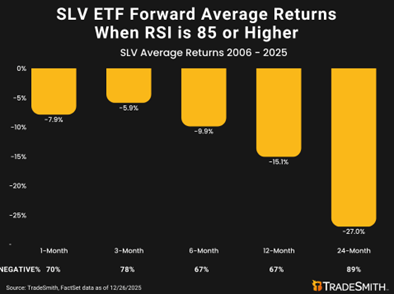

TradeSmith analyst Lucas Downey, editor of Alpha Signals, recently noted an extreme relative strength index (RSI) reading for the iShares Silver ETF (SLV). That’s an extreme, which historically has indicated trouble ahead.

As you can see above, the RSI for SLV recently surged above 85, which signals an extreme overbought condition. And after similar extremes historically, SLV traded lower 70% of the time over the next month, for an average loss of 7.9%, based on data since 2006.

Worse, over even longer time frames from three months out to two years, silver has been down more than up, with negative average returns in every time frame. Down 15% at the 12-month mark, and down 27% two years later.

Bottom line: Historical tendencies like this don’t always hold true and it could be different this time. But investors in silver who scored windfall gains may want to consider taking some profits now, or at least tightening their stops.

Good investing,

Mike Burnick

Contributing Editor, Market Minute