Yesterday’s news of a trade deal between the U.S. and the UK seems like good news. Bullish traders used it as a reason to charge into the market – helping the S&P 500 to rally to its highest level since “Liberation Day” in early April.

But, there’s a good chance folks who bought stocks yesterday will regret it in the days ahead. One of my favorite market-timing indicators suggests we’re nearing the end of the current rally phase.

Let me explain…

The PMOBUYALL is a momentum indicator that fluctuates between zero and 100. When it gets to zero, most of the fuel for a large decline has been used up. Traders should look to buy stocks into any additional weakness.

When the PMOBUYALL hits 100, most of the fuel for a rally has been used up. Traders should look to sell stocks and/or establish short positions into any additional strength.

Like most momentum indicators, PMOBUYALL is not an exact timing indicator. It merely tells us when stocks are in the ballpark of a reversal. We can then look to other indicators (like divergences) to fine tune the timing of trades.

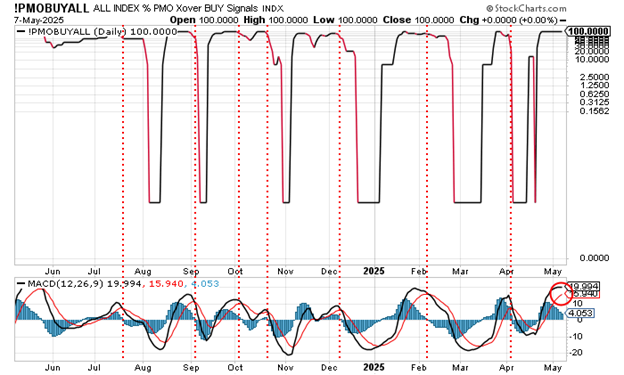

The following chart of the PMOBUYALL can help explain why stocks are nearing a short-term decline phase…

The PMOBUYALL rallied as high as 100 seven previous times over the past year. Each time this happened the S&P 500 was near a short-term high. The stock market declined each time the MACD turned lower when the PMOBUYALL was in this condition.

The PMOBUYALL hit 100 about two weeks ago. It has been stuck at the 100 level ever since then. Now, the MACD indicator is starting to turn lower.

If the current situation plays out like the seven previous situations did, then we should see a decline phase get started any day now.

My guess is the S&P could drop 200-300 points in just a few days – just to work off the current overbought conditions and push the PMOBUYALL back down towards zero.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.