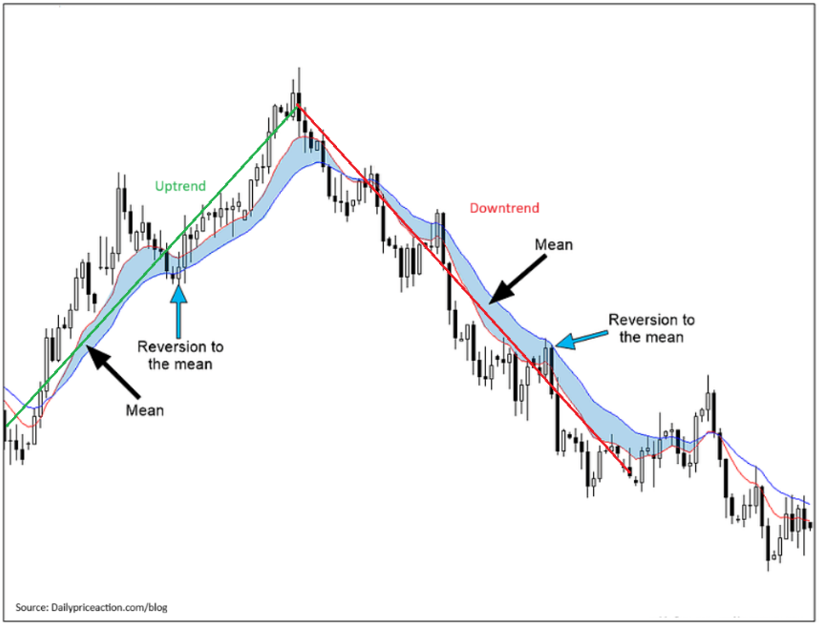

I learned a long time ago as a newbie stockbroker that financial markets spend their time doing one of two things.

- Trending up or down, or

- Mean reverting

That’s a fancy Wall Street term for what Sir Isaac Newton observed over 300 years ago: For every action, there is an equal and opposite reaction.

Reversion to the mean, as illustrated above, happens on a regular basis in both uptrends and downtrends. But we haven’t experienced much mean reversion recently…

I should add that markets also spend time in trading ranges, but that’s really just another form of mean reversion – only on a smaller scale – as stocks bounce up and down in a wave pattern. Not trending much in either direction.

I bring this up because stocks have enjoyed one heck of an uptrend since April. There have been a few brief mean reversions along the way, including the pullback over last few weeks.

But really… too little mean reversion to mention.

Both Jeff and I are believers in mean reversion, and at some point, perhaps sooner than you think, we will experience it with stocks.

It’s simply the price we must pay for the profitable uptrends.

In fact, a bit of mean reversion for stocks may have already started. And if so, future returns don’t look good.

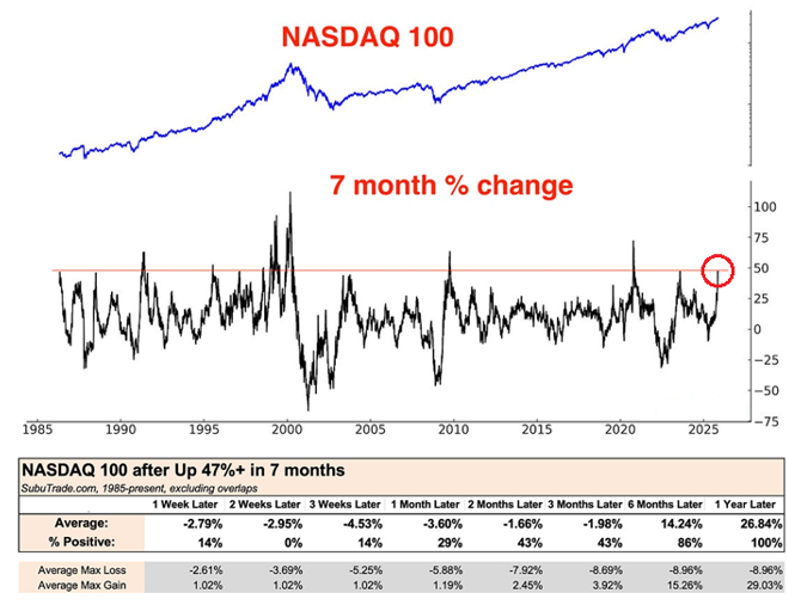

The Nasdaq 100 Index has been up for the past 7 months straight, gaining over 50% during this remarkably strong uptrend.

But the trouble is, such strong momentum historically is most often followed by losses in the months ahead, before the uptrend resumes.

In fact, as shown above, since 1991 Nasdaq has posted consistent average losses up to 3 months after similarly strong uptrends in the past. That’s mean reversion at work.

The worst reversion period has been 3-4 weeks later, with average losses of -3.6% to -4.5% over that period and the Nasdaq 100 declining nearly 80% of the time!

Bottom line: There’s a memorable line from the film Wall Street when a veteran broker takes newbie Bud Fox by the shoulder and says: “Enjoy it while it lasts kid, because it never does.” I sincerely hope investors enjoyed the 7-month, 50%+ uptrend in Nasdaq, because now it may be time to pay the price with some mean reversion.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

P.S. Jeff Clark’s favorite – and most profitable – trading is done while taking advantage of the reversion-to-the-mean stage in markets. It’s how he locks in gains for subscribers whether the market is moving up… down… or sideways. Learn more about that strategy right here.