Managing Editor’s Note: Jeff Clark and TradeSmith – premier provider of fintech software and financial newsletter behemoth – have teamed up.

It’s a perfect match, because at the core of both Jeff’s and TradeSmith’s mission is a very simple philosophy: dedication to helping everyday investors navigate volatile periods like we’re in now, so you can profit on both the ups and downs in markets with the least amount of risk.

And today, we’re hearing from our brand-new contributing editor Mike Burnick for the first time.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

You’ll now be hearing from Mike weekly, on Thursdays in TradeSmith’s Market Minute.

Mike believes that a consistent and reliable method for generating income, even when times are tough, is the true key to financial freedom and living a carefree life of leisure.

Jeff shares this belief. And the first time Jeff and Mike sat down together, it was clear that their trading, investing, and financial outlooks meshed beautifully.

Without further ado, here’s Mike…

We’re Looking at a Rebound Rally for Stocks

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE

The stock market has been on a one-way ride to the downside over the past month, but now we’re finally seeing signs pointing to a rebound rally.

The S&P 500 Index closed lower in six out of the past seven weeks. This kind of severe selling stampede is unusual and was triggered mainly by fear of the unknown.

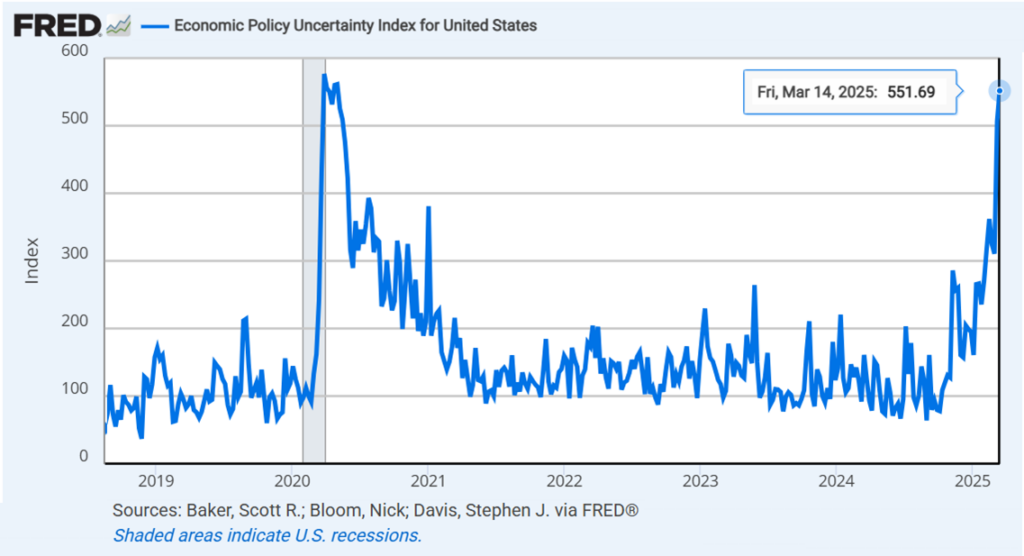

Economic policy uncertainty spiked to levels not seen since the 2020 pandemic.

Back then, just like now, conflicting signals about trade policies, include tariff threats against key trading partners, triggered high levels of unpredictability in the economy and roiled financial markets.

In fact, uncertainty today is well above the highs recorded during Trump’s first term in the White House when trade was also a hotly debated topic.

The Market Doesn’t Like Uncertainty

Stocks don’t like uncertainty… and that’s exactly why it seems like a trapdoor opened under stock prices.

But today, investor fear is so thick you can cut it with a knife… and that’s often when market lows form. The market’s so-called fear gauge, the CBOE Volatility Index (VIX) just hit levels that, just like Jeff said in a recent essay, have provided reliable buy signals for stocks.

Meanwhile, investor sentiment by several measures fell to extreme bearish levels. Data from Investors Intelligence shows the most bearishness since the 2022 bear market.

Both Jeff and I believe sentiment indicators like this tend to be reliable contrary indicators (just check out Jeff’s recently unveiled “wife indicator”!

In other words, everyone is so bearish there’s nobody left to sell… which is bullish.

And sure enough, buyers finally stepped into the market in recent days and completely overwhelmed the sellers.

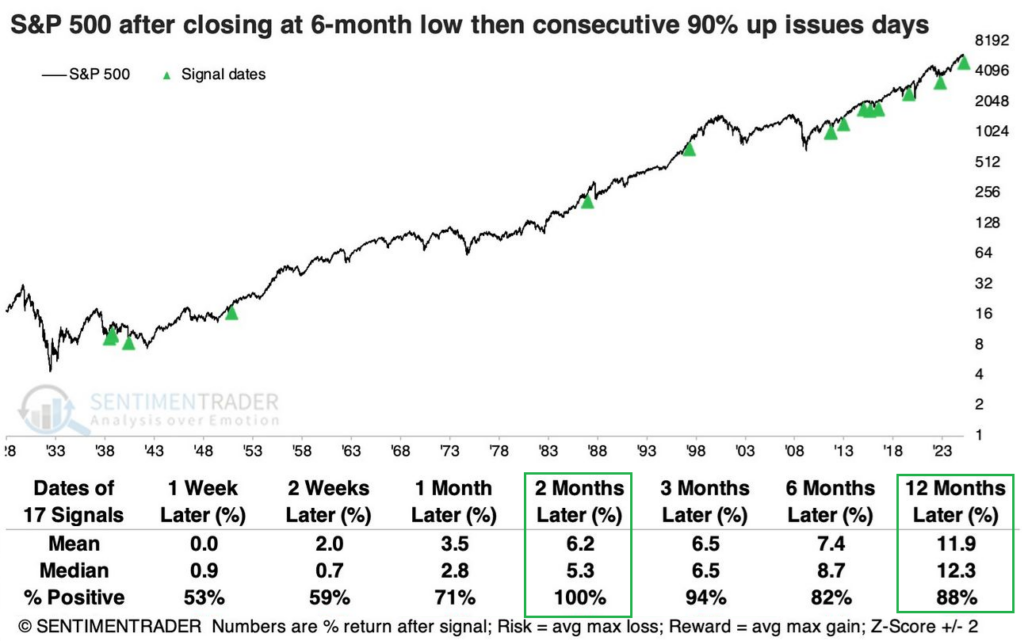

In last Friday’s trading, and again Monday, the S&P 500 Index experienced back-to-back 90% upside days. That’s when 90% of index stocks close higher for the day.

Historically, when overwhelming positive breadth like this happens on consecutive days with the S&P 500 at six-month lows, stocks have always been higher two months later, with the S&P posting average gains of 6.2% in the process, according to SentimenTrader data.

Zoom out to 12 months later and the S&P 500 has been higher 88% of the time with gains of nearly 12% on average.

Burnick’s Bottom Line: Stocks have really taken a beating over the past month, but with history as a guide, the swiftness of the decline may soon be mirrored by a sharp market rebound rally. Both negative sentiment and recent positive stock market breadth point to higher prices ahead.

Good investing,

Mike Burnick

Contributing Editor, Market Minute

READER MAILBAG

Like Jeff and Mike, do you think the market will be higher two months from now? What trading moves are you making? Let us know at [email protected].

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.