The buy signal was a bust. Oddly enough, though, that’s bullish.

Let me explain…

Last Friday, I boasted about the success of NYSE Summation Index (NYSI) buy signals. All seven of the previous signals since the start of 2024 led to immediate stock market rallies. So, I suggested readers should put money to work following last week’s NYSI buy signal.

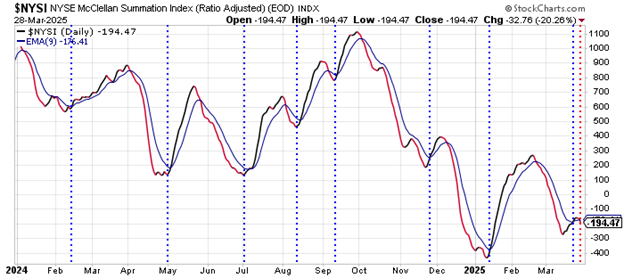

That signal failed on Friday when the NYSI closed back below its 9-day EMA. Here’s the updated chart…

The NYSI generates about five or six buy signals each year. The market is almost always higher one month later.

About once every two years, though, the NYSI buy signal fails and reverses almost immediately after it is triggered. That’s what happened on Friday.

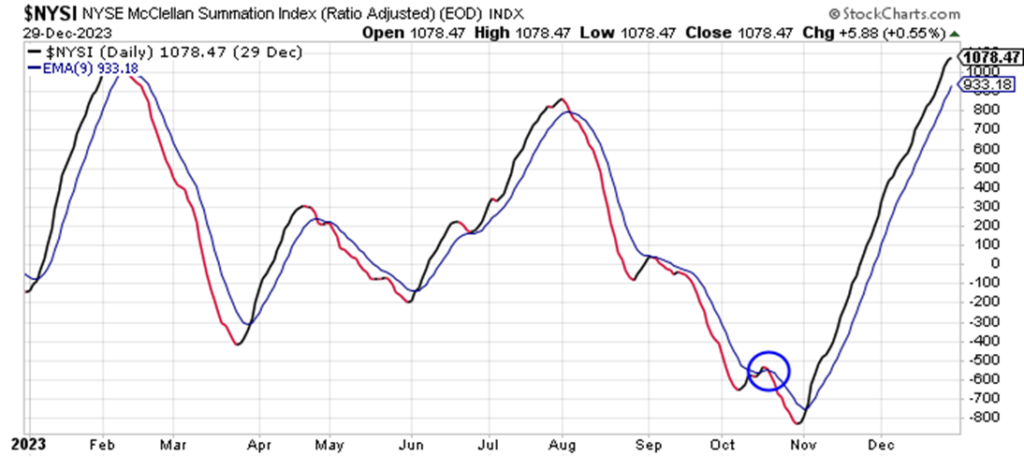

The last time a NYSI buy signal was negated was in October 2023. Here’s how that looked…

The buy signal triggered in mid-October. It failed immediately, and the NYSI declined until the end of the month. NYSI generated a new buy signal in early November.

Here’s how the S&P behaved back then…

The S&P 500 lost nearly 200 points following the failed NYSI buy signal in mid-October. It recovered most of that decline by the time it triggered a new buy signal in early November. The index went on to gain 300 more points by the end of November.

Folks who bought the failed buy signal in early October suffered some short-term pain. But, they were profitable less than a month later.

Folks who bought into the decline following the failed buy signal but before the second buy signal was triggered profited most.

All of this is to suggest that no matter how ugly it may get early this week, buying into the decline will likely prove profitable in the weeks ahead – especially if we see extremely oversold conditions on the daily indicators.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.