Managing Editor’s Note: Today, we’re hearing from our contributing editor Mike Burnick in his weekly Thursday feature.

Mike has over 30 years in the investment and financial services industry – from operating as a stockbroker, trader, and research analyst, to running a mutual fund as a registered investment advisor and portfolio manager, to being Research Director for the Sovereign Society, specializing in global ETF and options investing.

And he’s been senior analyst at TradeSmith for three years, running Constant Cash Flow, Infinite Income Loop, and Inside TradeSmith.

Here’s Mike…

When Volatility Is Exhausted, So Is the Selling

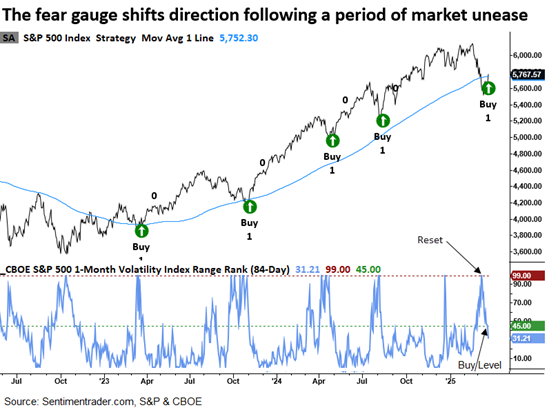

BY MIKE BURNICK, CONTRIBUTING EDITOR, MARKET MINUTE At times like this, reading the morning market headlines can give you a case of déjà vu… This recent headline is a case in point: “Stocks Week Ahead: Liberation Day Fallout, Jobs Data May Unleash Volatility Spike.” Where have I heard that before? Oh yeah, yesterday, and the day before that, and… It’s true that stocks have struggled to get any upside traction with all the negative headlines about tariffs triggering more market volatility. But a funny thing happened to the S&P 500 on its way to retest the lows this week… volatility didn’t go along for a ride to new highs… and that’s telling.

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.