If you felt a bit stressed out by the stock market 3% mini-crash on Friday, October 10, you’re not alone.

Volatility has picked up this month, right on cue with the typical seasonal trend. CBOE Market Volatility Index (VIX) spiked above 30 last week, before settling back a bit this week. But we may not be out of the woods just yet.

It’s true that seasonality does turn bullish once again as the calendar turns to November. But I’m beginning to think that the nearly straight-up rally since early September has pulled forward the usual year-end seasonal strength.

One way or the other, we should find out soon enough…

Here’s why…

You probably haven’t heard much about credit default swaps (CDX) in a while. But it was the one thing to watch like a hawk during the 2007-20008 global financial crisis.

Subprime home mortgage loans were at the heart of the 2008 meltdown. And CDX was the tool institutions used to protect themselves. Some hedge fund gurus, including Henry Paulson, earned hundreds of billions in profits buying CDX contracts during that crisis.

And I bring up this history lesson because like the VIX, this key measure of market turbulence is also ringing alarm bells again.

Today, it’s not subprime mortgages, but subprime auto loans that have been in the headlines for all the wrong reasons.

A large subprime auto lender just went belly up a month ago. And several big banks recently reported loan losses as a result.

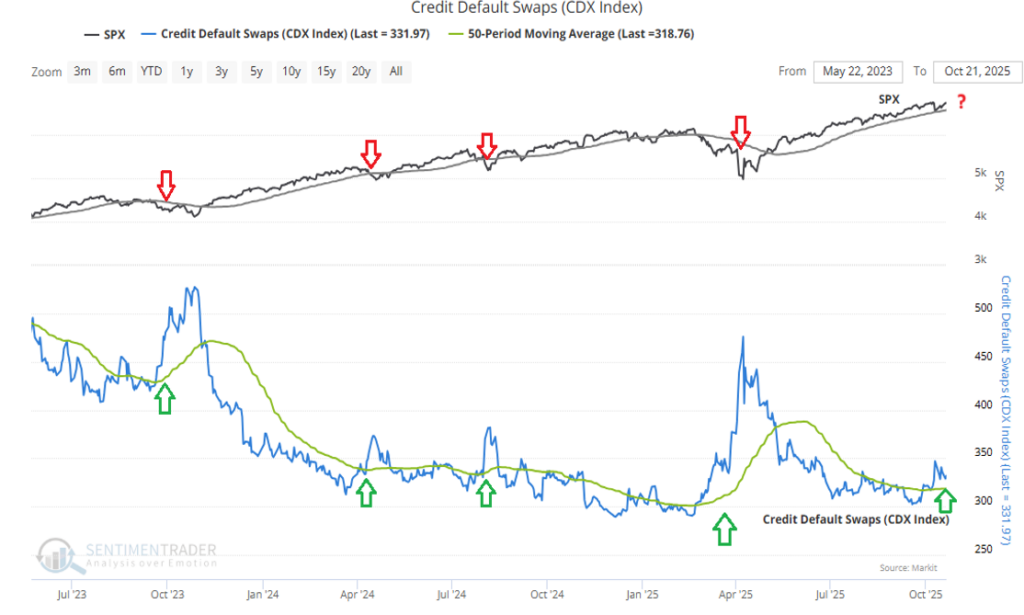

When CDX line above rises, it means credit stress is rising too, and investors must pay up for default swap protection.

You can see in the chart above that there is a close inverse relationship between the S&P 500 (at the top) and CDX (bottom). When CDX rises, stocks typically fall.

That’s exactly what happened during the tariff turmoil earlier this year. Also, notice that CDX rang the same alarm bell warning of market corrections several times in recent years.

Bottom line: Right now, it looks to me like credit default swaps are just beginning a similar uptrend again. In the past, whenever the CDX index trades above its 50-day moving average (green line in the chart above), stocks have usually struggled, and market correction risks rise.

Good investing,

Mike Burnick

Contributing Editor, Market Minute