The talking heads have flipped.

All those financial TV analysts who were preaching caution last Monday as the S&P was nearing 5100 are now talking bullish. “Get in now” they cheer as the index is trading 400 points higher.

Somehow, I suspect folks will regret that advice in the days ahead.

Last week’s action felt like a “bull trap.” That’s when reluctant bulls get coaxed back into the market just in time for the bear to take another swipe.

At first glance, there was nothing wrong with the action last week. The rally started slowly and then gained strength throughout the week as a steady stream of buyers kept showing up. Typically, this is bullish action.

But not when it creates extremely overbought conditions.

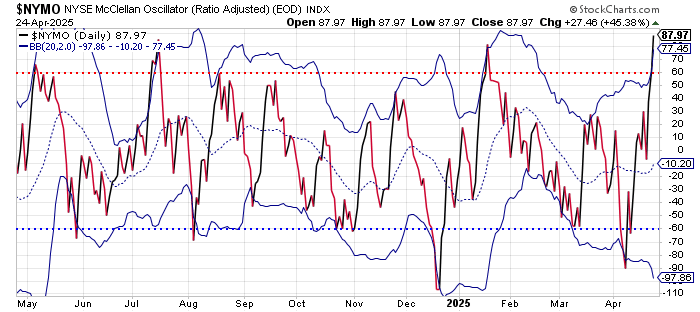

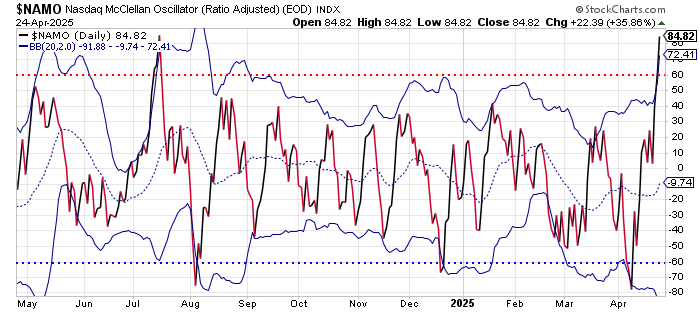

Look at these charts of the McClellan Oscillators…

NYMO and NAMO closed above their upper Bollinger Bands, and above the +60 level for two straight days.

Three days above the line is rare. Four days is almost unheard of. And, I don’t ever recall seeing this condition for five days.

The Oscillators also closed at their highest levels of the past year. The two previous times NYMO and NAMO got this high – in mid-January, and last July – the stock market struggled.

Here’s the S&P 500 chart…

Folks who bought stocks at either of those two points regretted doing so shortly afterwards.

Yesterday, as the market approached the opening bell, the S&P 500 was trading 143 points above its 9-day EMA. That’s an extended, overbought condition.

Yes… it is possible the S&P could run up towards it 50-day MA near 5650. A bullish trade headline could do the trick. At some point though, the early April low below 5000 needs to be retested.

So, we have roughly 150 points of potential upside versus 500 points of downside.

That seems to be a rather poor risk/reward setup.

That doesn’t mean traders should be betting on the downside and loading their portfolios with short-selling trades. But, it seems ill-advised to chase stocks higher with the technical indicators in extremely overbought territory.

All throughout the month of April I’ve suggested folks buy into weakness and sell into strength.

That has been a profitable strategy.

Now, though, as the strength is relentless, and we find ourselves with nothing left to sell, there’s a strong temptation to buy anything just to be involved in the rally.

That is what a bull trap feels like.

Don’t get caught in it.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.