Financial media talking heads are all anxiously anticipating how the financial market will react to Nvidia’s (NVDA) earnings report after the market closes on Wednesday. They believe the action will tell us how the stock market will behave for the rest of 2025.

If NVDA rallies following the report, the talking heads argue, then we’ll see the S&P 500 make new all-time highs. If NVDA falls, then the broad stock market is in trouble.

Maybe so, or maybe not.

There’s no doubt NVDA is an important stock. It makes up nearly 8% of the S&P 500. It’s a leading member of the Magnificent Seven. And, it is perhaps the most widely owned position among institutional portfolio managers.

But, if you really want to know the direction of the stock market for the next six weeks, watch the action in junk bonds instead.

As we’ve discussed many times here in Market Minute, the action in high-yield bonds – a.k.a. junk bonds – leads the action in the stock market by anywhere from two days to two weeks. That’s because junk bonds show us investors’ appetite for risk.

In a “risk-on” environment – where investors are willing to chase prices higher – high yield bonds rally first. When the environment shifts to “risk off,” and investors start pulling money out of the markets, junk bonds are among the first assets to get sold.

And, right now high-yield bonds are showing the most exciting setup in the financial market.

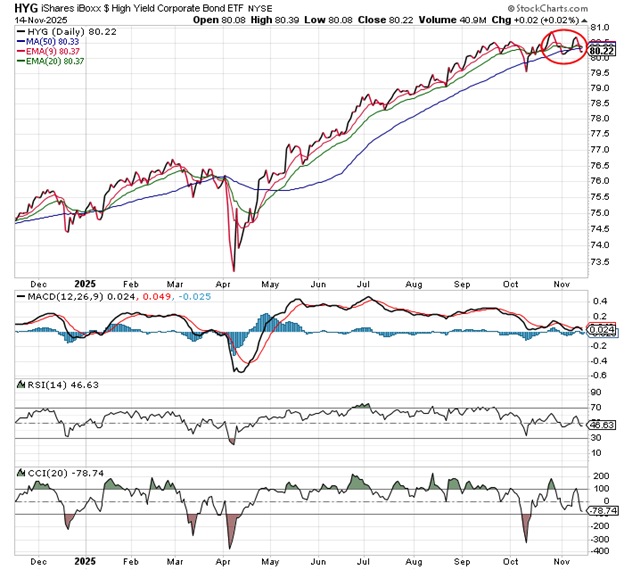

Take a look at this chart of the iShares iBoxx High Yield Corporate Bond Fund (HYG)…

HYG has been stuck in a relatively tight trading range since we last took a look at it in early October. During that time, all the various moving averages have coiled together. And, all the momentum indicators at the bottom of the chart have shifted into “neutral” territory.

There is a lot of energy built up in this chart. HYG is set to make a big move in one direction or the other.

Which way?

I have no idea. My natural bearish bias has me leaning to the downside. But, if I take off my bear-colored glasses I’m forced to admit it’s a coin toss. It can go either way.

The one thing I can say with confidence, though, is whatever direction HYG breaks the broad stock market will follow shortly afterwards. If HYG rallies, then we’ll likely see the S&P 500 top 7,000 by the end of the year. If HYG breaks down, however, then forget about a year-end rally for the stock market, and look out below.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just go here to check it out.