Managing Editor’s Note: Jeff Clark has teamed up with TradeSmith – the premier provider of fintech software, helping investors thrive in bull and bear markets for 20 years.

It’s also a financial newsletter behemoth featuring in-depth market analysis from some of the best and brightest names in the industry.

At the heart of this partnership, both TradeSmith and Jeff are dedicated to helping everyday investors navigate highly volatile periods, like we’re in now, so you can profit on both the ups and downs in markets, while exposing yourself to the least amount of risk.

To reflect this partnership, Jeff Clark’s Market Minute is becoming TradeSmith’s Market Minute.

Don’t worry, you’ll still get the same, quick-hit market analysis from Jeff three days a week… we’ll just be adding other expert analysts into our rotation… like Mike Burnick in our new Thursday slot.

As always, any questions or comments – good or bad – let us know at [email protected].

Gold Is Set for a Decline

BY JEFF CLARK, EDITOR, MARKET MINUTE

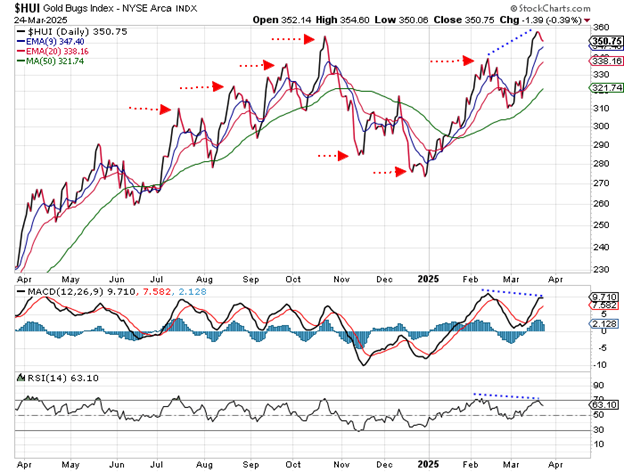

The gold sector looks vulnerable to at least a short-term decline – if not something a bit more ominous.

Admittedly, it’s hard to be bearish on gold stocks. The sector has been on fire in 2025. The Gold Bugs Index (HUI) started the year near $285 per share. It closed recently near $355. That’s a 25% gain in less than three months – putting the gold sector at the top of the leaderboard so far this year.

Now though, the gold sector is overbought. HUI is trading historically far above its 50-day moving average line. It recently rallied 10% in just one week. There’s negative divergence on the technical momentum indicators. And, it looks vulnerable to a swift pullback.

Take a look…

HUI rarely strays more than 8% away from its 50-day moving average (the squiggly blue line on the chart) before reversing and heading back towards the line. The red arrows on the chart point to the multiple times last year HUI traded 8% or more away from its 50-day MA.

Each time, the stock move reversed back towards the line almost immediately.

Recently, HUI closed more than 10% above its 50-day MA. It’s vulnerable to a downside reversal.

Notice also that on the rally this month, HUI made a higher high. But, the MACD and RSI momentum indicators are below the high levels established last month.

This sort of “negative divergence” is often an early warning sign of an impending decline.

Finally, HUI recently rallied for seven straight days. That sort of one-way move in the gold sector often marks a short-term buyers’ exhaustion. It’s on par with the action last October when HUI peaked and lost 18% over the next month.

We probably won’t see quite as large of a decline in the gold stocks this time around. But, the sector looks setup for at least a drop back towards its 50-day MA near $325.

Best regards and good trading,

Jeff Clark

Editor, Market Minute

P.S. Gold is one of my favorite things to trade. And I recently released a briefing about how you can become a successful trader and make tens of thousands of dollars in the stock market – over and over again – by trading just one stock (yes… in the gold market).

In fact, I’ve recommended trades on this one stock to my readers 37 times since 2019…

…For gains of 85% in 14 days… 120% in under 3 months… 176% in 5 weeks… 186% in 8 days… 195% in under a month… And even 222% in 8 days.

Check out how you can easily and quickly trade the gold markets – no matter if they’re heading up or down – right here.

Free Trading Resources

Have you checked out Jeff’s free trading resources on his website? It contains a selection of special reports, training videos, and a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.